Table of Contents

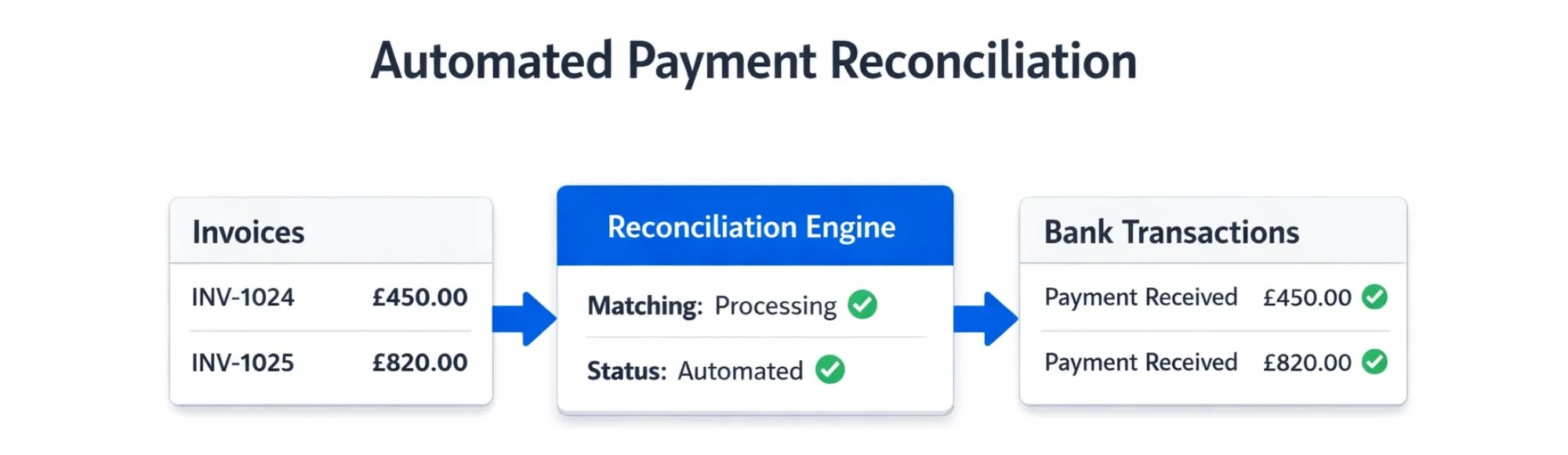

Finance teams waste hours matching bank transactions against invoices manually. Automated payment reconciliation fails when platforms cannot access real-time bank data without requiring CSV downloads from users.

Key Takeaways

What problem does this solve?

Platforms cannot build automated payment reconciliation when users must download bank CSVs manually and upload them for matching.

Why does infrastructure matter?

Direct bank connectivity provides structured transaction data. This enables platforms to build matching algorithms without manual data entry.

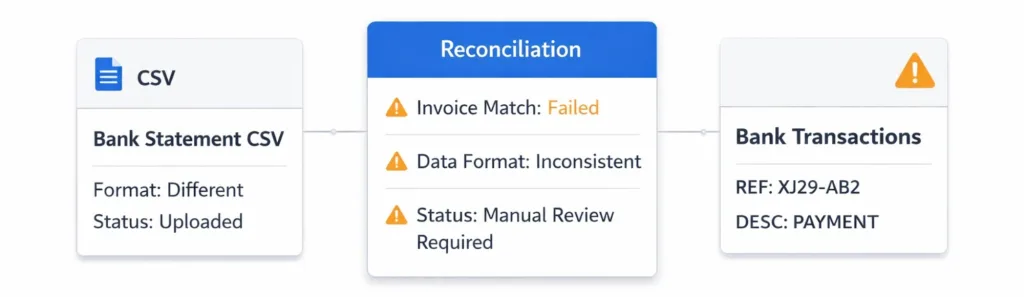

What breaks with CSV uploads?

Different banks format data differently. Manual uploads create delays. Real-time reconciliation becomes impossible. Users waste time on data entry.

What should UK platforms prioritise?

FCA-authorised infrastructure providing consistent transaction format across banks with real-time feeds and historical data access.

Where does Finexer fit operationally?

Finexer provides bank data infrastructure. Platforms build reconciliation matching logic, exception handling, and user workflows on top.

Why does automated payment reconciliation fail?

Accounting platforms promise automatic matching between bank transactions and invoices. But automated payment reconciliation requires continuous access to transaction data.

Users download bank statements manually from multiple institutions. Each bank formats CSV files differently. Column names vary. Date formats differ. Transaction descriptions are inconsistent.

Platforms cannot build unified matching logic when data arrives in unpredictable formats. Finance teams spend time reformatting files before automated payment reconciliation can even begin.

Real-time visibility remains impossible. Bank statements become available the next day at earliest. Users cannot see current cash positions or identify unmatched payments until manual downloads occur.

What happens when bank data access fails?

Reconciliation delays extend month-end close. Finance teams cannot finalize reports until all bank data is downloaded, formatted, and matched.

User experience suffers. Accounting software users expect automated workflows but encounter manual steps that prevent time savings.

Support costs increase. Platform teams troubleshoot format mismatches and help users with CSV uploads instead of building product features.

Competitive disadvantage grows. Platforms offering real-time reconciliation win clients away from those requiring manual bank data uploads.

According to HMRC Making Tax Digital requirements, platforms must maintain accurate transaction records with proper audit trails.

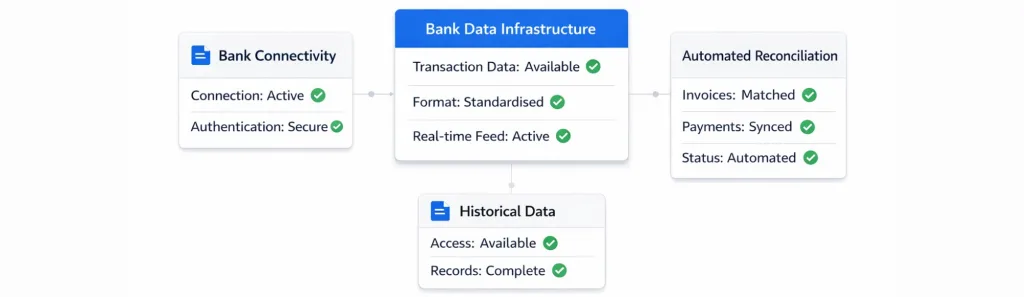

What infrastructure enables payment reconciliation automation?

Platforms need direct bank connectivity that delivers transaction data without user downloads. Each transaction should include structured fields like merchant name, amount, date, and reference numbers.

Data format must be consistent across all banks. Platforms cannot maintain separate parsing logic for each banking provider. Standardized structure enables unified matching algorithms.

Transaction feeds must update in real-time. Automated payment reconciliation delivers value when users see current positions, not yesterday’s data.

Historical access should extend beyond 90 days. Reconciliation often requires matching older transactions against invoices from previous periods.

User authentication must be simple. Complex bank login processes create friction that reduces feature adoption.

How does Finexer enable reconciliation automation?

Finexer provides FCA-authorised Open Banking infrastructure connecting platforms directly to UK banks.

Key capabilities:

- 99% UK bank coverage

- FCA-authorised infrastructure

- Real-time webhooks

- Up to 7 years historical data

- Usage-based pricing

- White-label ready

- 2-3x faster integration

- 3-5 weeks onboarding support

- Saves up to 90% on transaction costs

Transaction data arrives in consistent JSON format regardless of source bank. Platforms write matching logic once and apply it across all banking providers.

Real-time webhooks notify platforms when new transactions occur. Users see current positions without manual statement downloads.

Historical data access extends up to seven years depending on bank support. Platforms can reconcile past periods without requiring users to locate old statements.

User authentication happens once through banking apps. Consent remains valid without repeated logins. Users connect accounts and automated payment reconciliation begins immediately.

For platforms managing manual reconciliation processes, direct bank connectivity removes operational bottlenecks.

What should platforms check when evaluating providers?

Does the provider support all major UK banks? Incomplete coverage prevents users from connecting accounts, breaking automated payment reconciliation workflows.

Is data format consistent across banks? Platforms cannot build unified matching logic when transaction structures vary by provider.

Are transaction feeds real-time or batch-based? Delayed data prevents platforms from offering current position visibility that users expect.

Can platforms access historical transactions? Limited retention creates gaps when reconciling older invoices.

Is the provider FCA-authorised? Unauthorised providers create compliance risk for platforms processing client financial data.

Does webhook delivery remain reliable? Failed notifications create data gaps that undermine automated payment reconciliation accuracy.

Platforms building accounting and ERP features should confirm infrastructure provides all fields needed for matching algorithms.

Common Infrastructure Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Choosing screen scraping | Connections break during bank updates | FCA-authorised Open Banking infrastructure |

| Accepting inconsistent formats | Each bank requires separate parsing code | Standardised JSON structure across banks |

| Using batch-only feeds | Real-time features become impossible | Webhook notifications for new transactions |

| Limited bank coverage | Users cannot connect accounts | 99% UK bank support including challengers |

| Short historical access | Cannot reconcile past periods | 7-year transaction retrieval capability |

Platforms managing payment reconciliation for multiple invoices should prioritise infrastructure delivering reliable transaction data.

What I Feel

Most platforms underestimate the complexity of maintaining bank connectivity. Screen scraping works initially but creates constant operational overhead when authentication breaks across different institutions.

The mistake I see most often is building sophisticated matching algorithms while relying on manual data inputs. Reconciliation logic cannot compensate for inconsistent transaction formats or delayed feeds.

Platforms that choose cheap connectivity face ongoing support costs. Teams spend time fixing broken bank feeds instead of improving matching accuracy or user experience.

Automated payment reconciliation only delivers value when underlying data infrastructure remains reliable. Platforms serving finance teams who depend on accurate matching should treat bank connectivity as infrastructure investment, not technical feature.

For platforms handling payroll reconciliation, reliable transaction feeds eliminate manual verification work that slows month-end close.

What is automated payment reconciliation for platforms?

Automated payment reconciliation matches bank transactions against invoices without manual data entry. This requires direct bank connectivity providing structured transaction feeds.

Why does payment reconciliation require bank data access?

Manual CSV downloads create format inconsistencies and delays. Direct bank connectivity provides standardized transaction data enabling automated matching logic.

Can platforms build bank connectivity internally?

Platforms can build matching algorithms and workflows, but bank connectivity requires FCA authorisation. Most platforms use authorised infrastructure providers.

What makes Open Banking better for reconciliation?

Open Banking provides standardised bank connectivity with consistent transaction formats. This enables automated payment reconciliation without manual data reformatting.

How does real-time data improve reconciliation?

Real-time transaction feeds enable current position visibility and immediate matching. Users identify unmatched payments instantly instead of waiting for next-day statements.

Build automated payment reconciliation with FCA-authorised infrastructure and structured transaction feeds.