Table of Contents

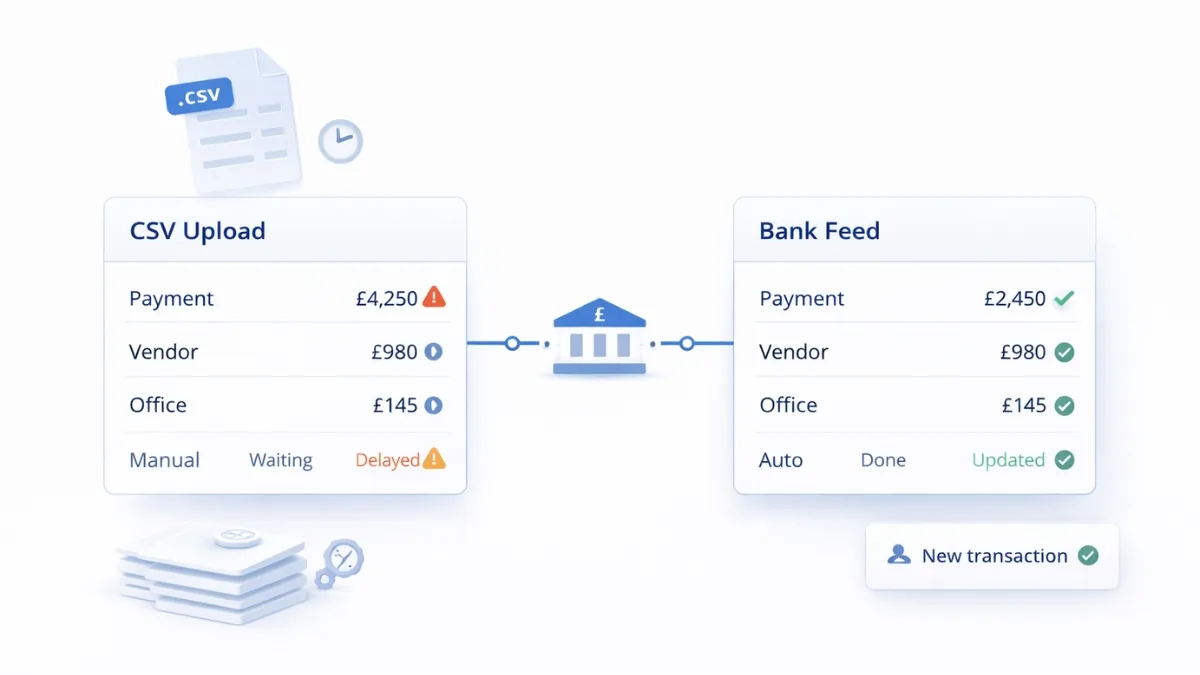

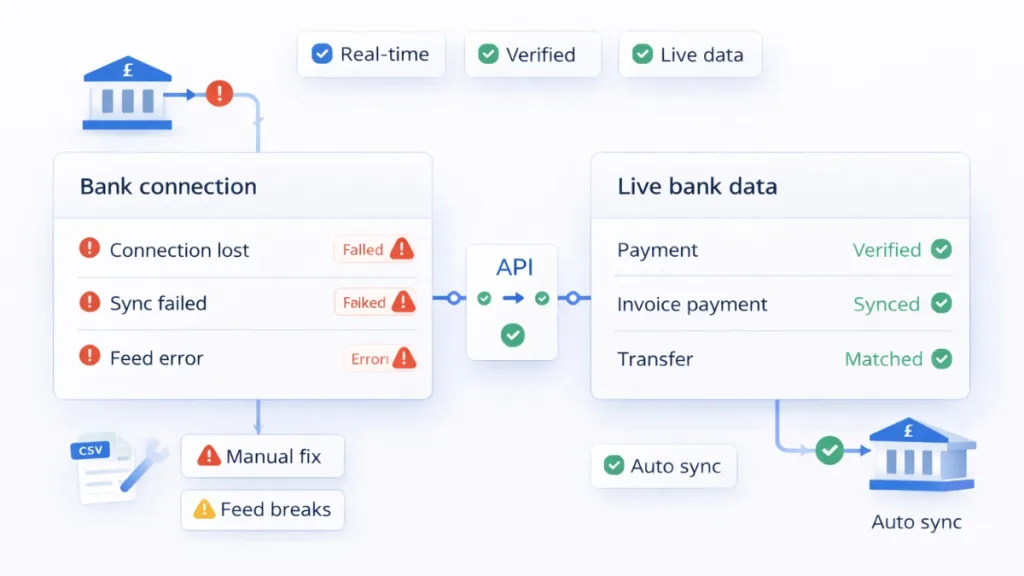

Accounting platforms cannot automate reconciliation when bank data arrives through manual CSV uploads or broken feed connections. Automation of accounting process requires structured transaction data that flows continuously without operational intervention.

Key Takeaways

What problem does this solve?

Platforms cannot automate accounting workflows when bank transaction data is delayed, incomplete, or requires manual uploads.

Why does infrastructure matter?

Direct bank connectivity provides verified transaction feeds. This enables reliable automation in accounting without manual data processing.

What breaks when using legacy methods?

CSV uploads and screen scraping create data gaps, reconciliation errors, and compliance risk that undermines automation benefits.

What should UK platforms prioritise?

FCA-authorised infrastructure that connects directly to banks and provides structured transaction data for automated accounting workflows.

Where does Finexer fit operationally?

Finexer provides bank connectivity infrastructure. Platforms build reconciliation logic, reporting features, and accounting workflows on top.

Why does the automation of accounting process fail?

Accounting platforms promise automated reconciliation, categorisation, and reporting. But automation of accounting processes depends entirely on transaction data quality and availability.

When platforms rely on CSV uploads, clients must download bank statements manually and upload them to the platform. This creates delays between transactions occurring and data becoming available for processing.

Bank feed connections built through screen scraping break frequently. When feeds stop working, platforms cannot process new transactions until technical teams fix connectivity issues.

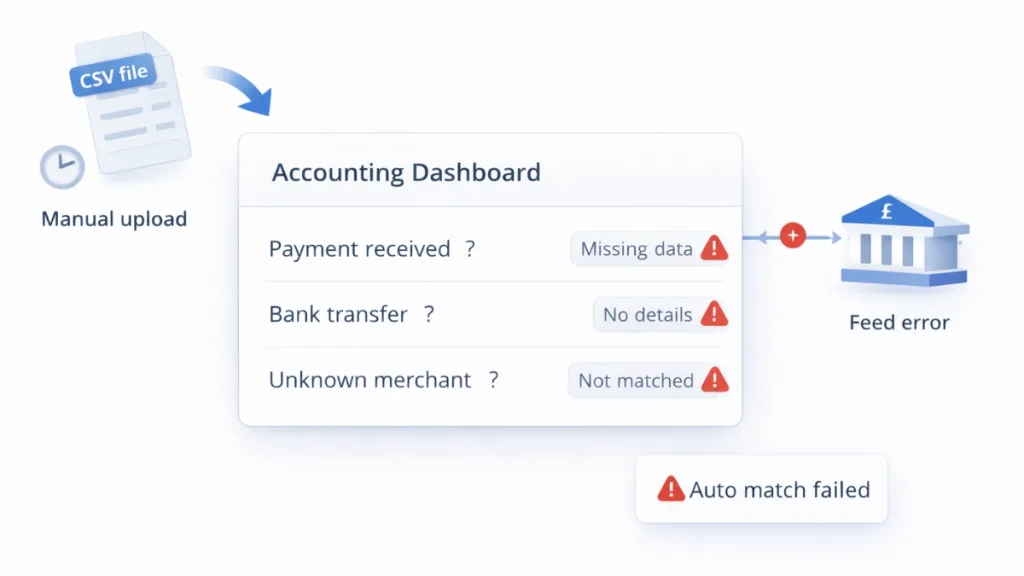

Missing transaction metadata prevents accurate categorisation. Generic transaction descriptions like “Payment received” lack detail needed for automated accounting process workflows.

What happens when bank data fails?

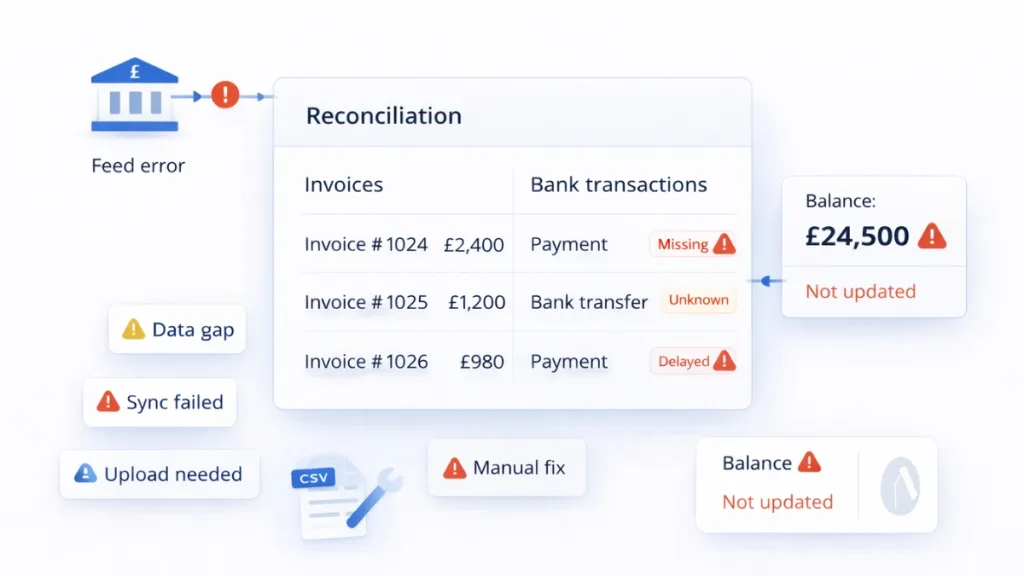

- Reconciliation breaks down. Platforms cannot match incoming payments against invoices when transaction data is delayed or incomplete.

- Financial reporting becomes unreliable. Management accounts show incorrect balances because recent transactions are missing from automated feeds.

- Compliance risk increases. Platforms managing client money cannot demonstrate proper audit trails when bank data contains gaps.

- Client satisfaction drops. Users expect real-time visibility into financial positions, but manual uploads prevent automation in accounting from delivering this experience.

- Operational costs rise. Support teams spend time troubleshooting broken feeds and helping clients with manual CSV uploads instead of focusing on product development.

What infrastructure enables reliable automation?

Platforms need direct bank connectivity that provides verified transaction data without manual intervention. Each transaction should include structured metadata showing merchant details, amounts, and timestamps.

Transaction feeds must update continuously. Platforms cannot automate accounting process workflows when data arrives in delayed batches requiring client action.

Historical data access should extend beyond 90 days. Automated reconciliation requires complete transaction history for matching payments against older invoices.

Consent management must be automated. Platforms need clear visibility into data access permissions without requiring clients to re-authenticate constantly.

Bank coverage must be comprehensive. Automation fails when clients using certain banks cannot connect their accounts to the platform.

According to HMRC guidance on Making Tax Digital, platforms supporting MTD compliance must maintain accurate transaction records with proper audit trails.

How does Finexer enable accounting automation?

Finexer provides FCA-authorised Open Banking infrastructure that connects platforms directly to UK banks. This includes Lloyds, Barclays, Monzo, Starling, and 99% of UK banking providers.

Bank transaction data flows continuously through real-time webhooks. Platforms receive notifications when new transactions occur, enabling immediate processing for automation of accounting process workflows.

Transaction data includes structured metadata. Each transaction contains merchant information, categorisation hints, and verified amounts that improve automated processing accuracy.

Historical data access extends up to seven years depending on bank support. Platforms can reconcile complete financial histories without manual statement uploads.

Consent lifecycle management is automated. Finexer handles permission tracking with clear expiry dates, reducing client re-authentication friction.

Integration support is provided during onboarding. Platforms remain responsible for building reconciliation logic, categorisation algorithms, and reporting features on top of the infrastructure.

Finexer’s key capabilities include:

- 99% UK bank coverage

- FCA-authorised infrastructure

- Real-time webhooks

- Up to 7 years historical data

- Usage-based pricing

- White-label ready

- 2-3x faster integration

- 3-5 weeks onboarding support

- Saves up to 90% on transaction costs

For platforms managing accounting workflow automation features, direct bank connectivity removes operational bottlenecks that prevent reliable automation in accounting.

What should platforms check when evaluating providers?

Does the provider support all major UK banks?

Incomplete coverage creates user experience problems when clients cannot connect their accounts.

Are transaction feeds real-time or batch-based?

Delayed data delivery prevents platforms from offering automated reconciliation that users expect.

Does transaction data include merchant metadata?

Generic descriptions reduce automation accuracy and require manual intervention.

Is historical data accessible beyond 90 days?

Short retention limits prevent complete financial history reconstruction.

Can platforms track consent status programmatically?

Manual consent management creates operational overhead and user friction.

Is the provider FCA-authorised for Account Information Services?

Unauthorised providers create compliance risk for platforms processing client financial data.

Platforms building accounting and ERP integrations should confirm that bank connectivity provides all data fields needed for automated workflows.

Common Infrastructure Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Relying on CSV uploads | Manual processes prevent automation and create data delays | Direct bank connectivity with automated feeds |

| Using screen scraping | Fragile connections break frequently, disrupting automation | FCA-authorised Open Banking infrastructure |

| Accepting generic transaction data | Poor metadata quality reduces categorisation accuracy | Structured transaction data with merchant details |

| Choosing providers with limited bank coverage | Users cannot connect accounts, breaking automation workflows | 99% UK bank coverage including challengers |

| Ignoring consent management | Manual re-authentication creates user friction | Automated consent tracking with expiry management |

Platforms offering automated bookkeeping features should prioritise infrastructure that provides reliable transaction feeds without operational intervention.

What I Feel

Most platforms underestimate how fragile bank feed connections become at scale. Screen scraping works initially but creates constant operational overhead when connections break across different banks.

The mistake I see most often is building sophisticated automation in accounting logic while relying on unreliable data sources. Reconciliation algorithms cannot compensate for missing or delayed transaction data.

Platforms that choose cheap connectivity solutions face ongoing support costs. Teams spend time troubleshooting broken feeds instead of building product features that differentiate the platform.

Accounting automation only delivers value when underlying data infrastructure is reliable. Platforms serving clients who depend on accurate financial reporting should treat bank connectivity as infrastructure investment, not technical feature.

The scaling benefit comes from eliminating manual intervention. Platforms that integrate proper infrastructure can onboard clients without requiring CSV uploads or feed troubleshooting.

What is automation of accounting process?

Automation of accounting process involves using software to handle reconciliation, categorisation, and reporting without manual data entry. This requires continuous access to verified bank transaction data.

What is an automated accounting process for platforms?

An automated accounting process eliminates manual bank statement uploads by connecting directly to banks through Open Banking infrastructure. Platforms receive real-time transaction feeds that enable automated reconciliation and reporting.

Which accounting system is used in the UK?

UK accounting platforms typically use cloud-based systems that integrate with Open Banking infrastructure for automated bank feeds. This enables real-time financial data access and MTD compliance.

Why does automation in accounting require bank connectivity?

Manual CSV uploads and broken feeds create data gaps that prevent automated workflows. Direct bank connectivity provides continuous transaction feeds needed for reliable automation.

What makes Open Banking better for accounting automation?

Open Banking provides standardised bank connectivity with structured transaction data. This enables reliable automation of accounting processes without manual uploads or fragile screen scraping.

Build reliable accounting automation with verified transaction data.