Table of Contents

One Infrastructure Layer for Payments and Bank Data

Platforms embedding api financial services don’t need another vendor comparison. They need reliable infrastructure handling both payment initiation and account data access without separate integrations.

Legacy approaches create slow deployments, broken connections, and reconciliation overhead. Teams spend months connecting payment rails, bank data providers, and compliance layers separately.

Key Takeaways

What operational risk does fragmented infrastructure create? Multiple vendor integrations increase failure points and reconciliation complexity at scale.

Why does infrastructure reliability matter more than interface design? Consent flows break silently. Data feeds stop updating. Payment confirmations delay.

What breaks when platforms choose cheaper API financial services providers? Limited bank coverage causes user drop-off. Batch-only feeds prevent real-time features. Screen-scraping breaks during bank updates.

What should UK platforms prioritise when evaluating providers? Bank coverage percentage, webhook availability, AIS+PIS in single integration, realistic onboarding timelines.

Where does Finexer fit operationally? FCA-authorised Open Banking connectivity enabling both payments api and account data access through unified infrastructure.

Where Teams Get Stuck

Chasing bank statements manually. Users download PDFs. Support verifies authenticity manually. Onboarding takes days.

Broken data connections. Screen-scraping breaks when banks update login flows. Platforms discover failures from user complaints.

Multiple vendor management. One for data. Another for payments. Third for compliance. Integration complexity multiplies.

Extended onboarding. Direct bank integrations take 6-12 months per institution.

Limited bank coverage. Supporting only major banks excludes challenger bank users.

What Platforms Need from API Financial Services

When product teams search for api financial services, they’re evaluating specific capabilities:

Bank account data access via AIS. Payment initiation via PIS. Consent-based authorisation maintaining product experience. Structured transaction data across 99% of UK banks. Ongoing data access via webhooks. White-label integration maintaining brand continuity.

Understanding Open Banking API integration requirements helps technical teams see the infrastructure architecture needed for production-ready implementations.

What Strong Infrastructure Provides

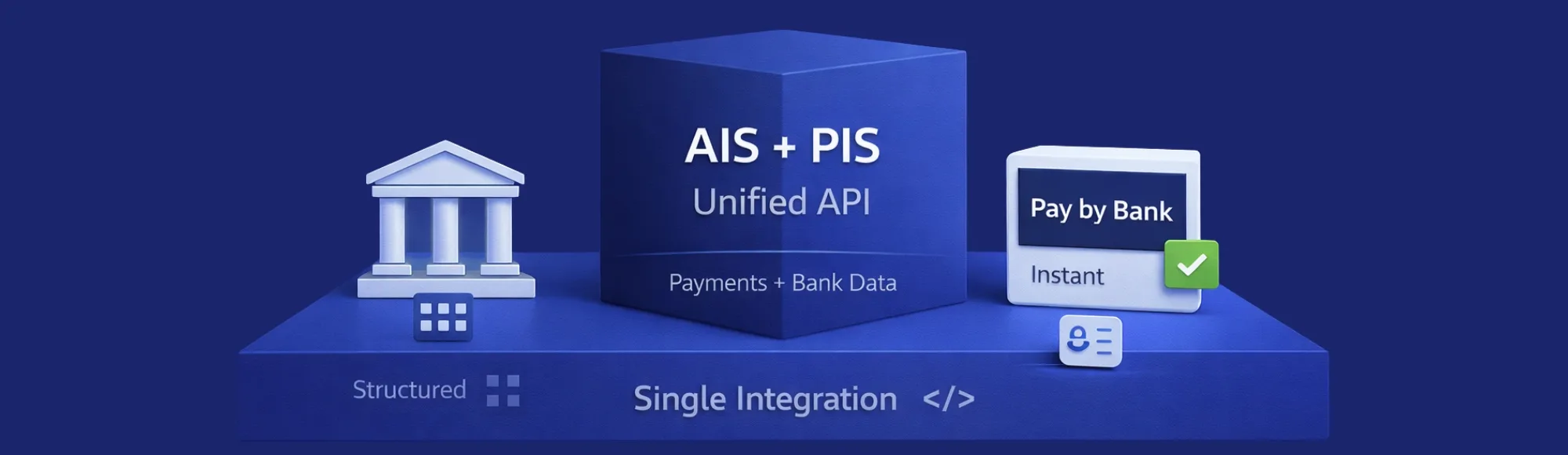

- AIS + PIS in single integration: Both account data and payment initiation without managing separate vendors.

- White-label consent flows: Maintains brand continuity without redirecting users to provider-branded pages.

- Historical transaction data: Access up to 7 years depending on bank data retention.

- Real-time webhooks: Notifications for transactions, balance changes, payment status without polling.

- Pay by Bank + Request to Pay: Complete api payments capabilities with instant confirmation.

- Full-featured sandbox: Testing environment with realistic data for development.

- 99% UK bank coverage: Across high-street banks, challengers, and building societies.

- Usage-based pricing: No fixed minimums, volume commitments, or long-term contracts.

What We See in Practice

Teams start with CSV uploads or screen-scraping. Add separate payment providers. Then discover they need compliance infrastructure tying everything together.

The fragmentation creates operational problems. Finance teams reconcile across multiple dashboards. Engineering maintains separate integrations. Support troubleshoots failures across providers.

Eventually, platforms look for unified Open Banking infrastructure handling both payments api and data access.

Common Evaluation Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Data-only or payments-only providers | Requires multiple integrations | AIS + PIS in single integration |

| Batch-only data feeds | Prevents real-time features | Real-time webhooks |

| Limited bank coverage | User drop-off | 99% UK coverage |

| Fixed pricing contracts | Cash flow pressure | Usage-based pricing |

| Screen-scraping infrastructure | Breaks during updates | FCA-authorised Open Banking |

| Self-service only | Extended timelines | Hands-on technical support |

Where Finexer Fits

Finexer provides Open Banking connectivity using FCA-authorised infrastructure. We offer AIS + PIS through single integration. Platforms access Pay by Bank, Request to Pay, and account data without managing separate providers.

99% UK bank coverage including Lloyds, Barclays, Monzo, and challengers. Platforms can verify which UK banks are supported before integration. Usage-based pricing without minimums. 3-5 week onboarding assistance from the engineering team. White-label consent maintaining brand. Real-time webhooks for transaction updates.

Finexer does not provide tax calculation or accounting functionality. We provide verified bank connectivity that platforms integrate for financial features.

Example Use Cases

Accounting: Transaction reconciliation via bank feeds. Payment collection via Pay by Bank.

Legal: Source-of-funds verification. Client account validation for settlements.

EPOS: Pay by Bank at point of sale. No card fees.

Lending: Income verification. Automated affordability checks.

Where This Works – Where It Doesn’t

Works for: UK-first products, SaaS platforms adding finance features, marketplaces, fintech building on Open Banking, B2B platforms.

Not ideal for: Consumer-only apps, one-off tools, platforms outside the UK, teams wanting pre-built software.

How to Evaluate Providers

Does the provider support 99% of UK banks including challengers? Real-time webhooks or daily batches? Both Pay by Bank and Request to Pay? 3-5 weeks with support or 6+ months solo? Usage-based or fixed contracts? AIS + PIS together or separate vendors?

Most financial services api providers optimise for demo speed. Few optimise for production reliability.

What I Feel About API Financial Services

API financial services are infrastructure decisions, not feature purchases. But evaluations treat them like SaaS subscriptions.

Platforms compare pricing spreadsheets. Then discover real differences during integration. Does consent feel native? Can you initiate api payments reliably? Does data reconcile consistently?

Operational differences appear at scale. A provider with higher per-transaction costs but reliable webhooks provides better economics than cheaper providers requiring manual reconciliation.

Evaluate based on operational fit, not marketing materials. You’re choosing infrastructure for years.

What are API financial services?

API financial services provide programmatic access to payment capabilities and bank account data through Open Banking infrastructure for platforms building embedded finance features.

What is a financial services API?

A financial services api is infrastructure enabling platforms to access payment rails and bank data without direct bank integrations or separate compliance management.

What is a payments API?

A payments api allows platforms to initiate payments from user bank accounts via Open Banking, supporting Pay by Bank workflows.

What are API payments?

API payments enable platforms to trigger account-to-account payments programmatically using Open Banking payment initiation services.

How long does integration take?

Most UK platforms complete api financial services integration in 3-5 weeks with hands-on technical support.

Build on Unified Payment & Data Infrastructure

See how Finexer’s Open Banking connectivity provides payments and account data through single integration

Book Demo Now