Table of Contents

Regulatory Confusion Slows Product Builds

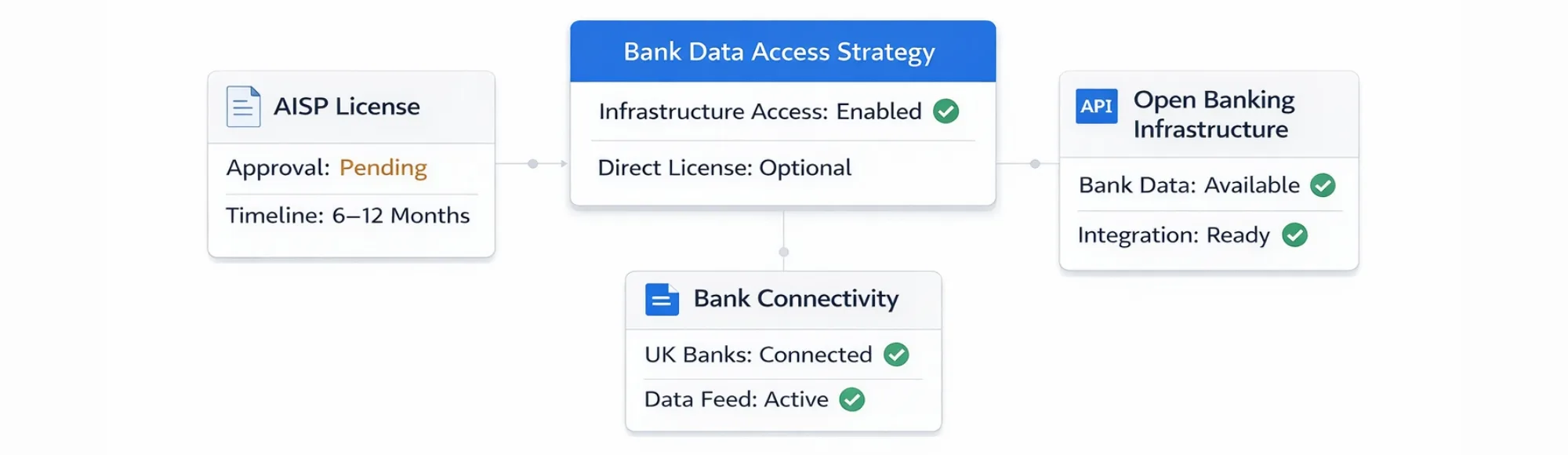

You want to access bank transaction data for your platform. Regulatory research suggests you need an AISP license. The FCA authorisation process seems heavy. Product development stalls during regulatory evaluation.

Fintech founders face this decision repeatedly. Build product first or apply for license first. Regulatory uncertainty delays launch timelines.

Key Takeaways

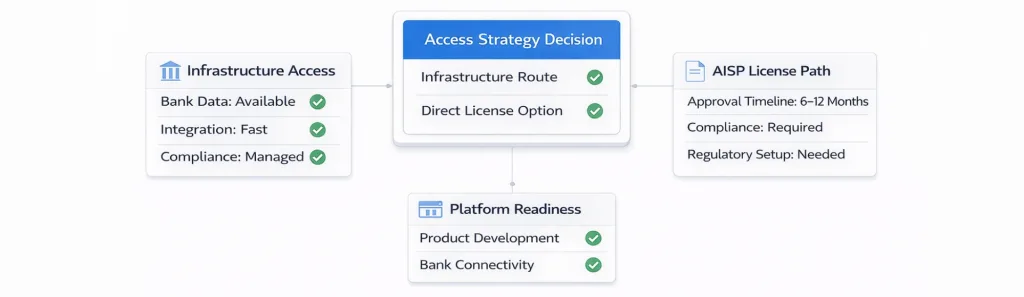

Do you actually need direct FCA authorisation?

Depends on your business model. Some platforms require direct authorisation. Others use FCA-authorised infrastructure to access bank data without becoming directly regulated.

What will ongoing compliance cost you operationally?

Beyond application costs, licensed entities handle ongoing reporting, audit requirements, safeguarding obligations, and capital requirements. Operational burden compounds over time.

Are you building infrastructure or a product?

If the focus is product features, the infrastructure route avoids regulatory operations. If focus is becoming a regulated entity, direct licensing makes sense.

Does your roadmap require full regulatory ownership?

Some business models require direct FCA relationships. Others benefit from an infrastructure model where compliance is handled by an authorised provider.

Can FCA-authorised infrastructure cover your use case?

Most AISP open banking use cases work through an infrastructure model. Direct licensing becomes relevant at specific scale or business structure.

Who This Applies To

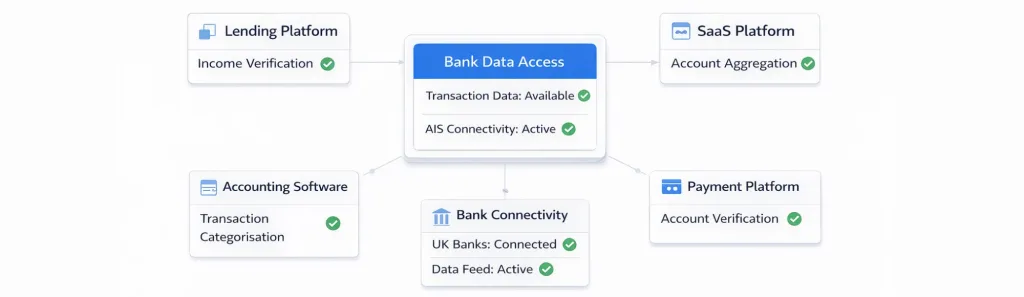

Fintech platforms building lending products: Income verification requires bank transaction data access

SaaS platforms adding financial verification: Account aggregation features need AIS connectivity

Accounting software providers: Transaction categorisation requires bank data feeds

Payment platforms expanding capabilities: Account verification before payouts needs AIS access

This decision affects platforms accessing bank data. Not consumer apps. Not retail users.

The Impact of Getting This Wrong

When licensing decisions delay product development:

Launch timeline extends:

- Regulatory approval takes 6-12 months minimum

- Product sits waiting for authorisation

- Market opportunity narrows

Legal uncertainty grows:

- Operating without proper authorisation creates risk

- Investor due diligence raises compliance questions

- Partnership discussions stall on regulatory clarity

Compliance costs increase:

- Application fees are initial cost only

- Ongoing reporting requires dedicated resources

- Audit requirements need operational capacity

- Capital requirements affect cash flow

Engineering remains blocked:

- Cannot access production bank data during approval

- Cannot test user flows properly

- Cannot validate product-market fit

The decision compounds. Choosing a licensing route means committing to regulatory operations long-term.

Understanding the difference between AISP and PISP helps clarify which authorisation your use case requires.

What an AISP License Actually Means

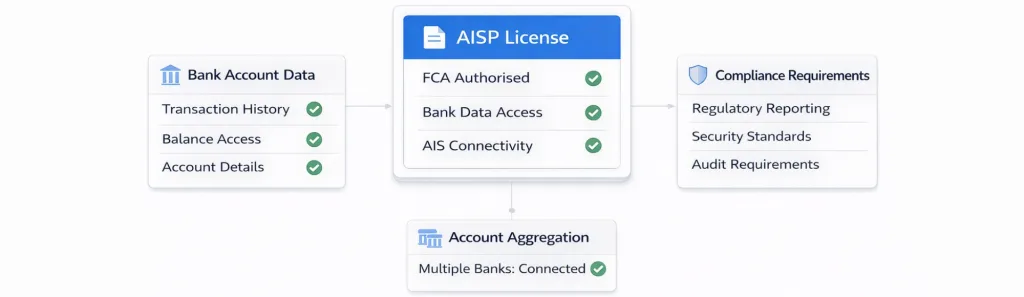

AISP license provides FCA authorisation for Account Information Service Providers under UK Open Banking regulations.

What it enables:

- Access to customer bank account data with consent

- Read-only transaction history retrieval

- Balance and account detail visibility

- Multi-account aggregation capability

What it requires:

- FCA application and approval process

- Ongoing regulatory reporting

- Compliance monitoring systems

- Professional indemnity insurance

- Information security standards

- Operational resilience requirements

- Audit trail maintenance

Operational burden:

- Dedicated compliance resources

- Regular FCA submissions

- Security audit requirements

- Incident reporting obligations

- Consumer duty compliance

This is not one-time approval. AISP license holders maintain regulatory relationships continuously.

The Alternative: Infrastructure Route

Some platforms access bank data through FCA-authorised infrastructure instead of becoming directly regulated.

How this works:

- Platform integrates with FCA-authorised provider

- Provider holds AISP license and handles compliance

- Platform receives bank data through API

- Regulatory burden stays with infrastructure provider

When this makes sense:

- Product focus over regulatory operations

- Faster time to market priority

- Capital constraints around licensing costs

- Team lacks compliance expertise

- Use case fits within infrastructure model

When direct licensing makes more sense:

- Business model requires direct FCA relationship

- Scale justifies regulatory investment

- Strategic positioning needs licensed status

- Regulatory ownership is competitive advantage

The infrastructure model does not eliminate all compliance. Platforms still handle data protection, consumer duty, and contractual obligations. But operational regulatory burden differs significantly.

Platforms building features requiring bank transaction API access often use infrastructure models initially.

Where Finexer Fits

Finexer operates FCA-authorised Open Banking infrastructure for UK platforms.

We handle AIS connectivity. Platforms focus on product features.

How Finexer enables AIS access without direct licensing:

Problem: Platform needs bank transaction data but licensing delays launch

Finexer provides: FCA-authorised AIS infrastructure providing bank data access

Platform result: Access production bank data during product development

Problem: Compliance operations consume engineering capacity

Finexer provides: Infrastructure handling regulatory reporting and audit requirements

Platform result: Engineering focuses on product features, not compliance systems

Problem: Capital requirements strain early-stage cash flow

Finexer provides: Usage-based pricing without licensing capital commitments

Platform result: Pay for API usage, not regulatory infrastructure

Problem: Bank coverage gaps affect user experience

Finexer provides: Connection to UK banks through single integration

Platform result: Users connect accounts regardless of banking provider

Infrastructure specifics:

- FCA-authorised AISP infrastructure

- AIS connectivity to UK banks

- Structured transaction data format

- Historical data access up to 7 years

- Real-time feeds via webhooks

- Usage-based pricing per API call

- 3-5 weeks integration support typical

This is the infrastructure layer. Platforms build verification, aggregation, and categorisation features users see.

Evaluation Framework

Before choosing between licensing and infrastructure:

Business model assessment:

- Does your model require a direct FCA relationship?

- Is regulatory ownership a competitive advantage?

- Will investors require licensed status?

Resource evaluation:

- Can you allocate compliance team capacity?

- Is capital available for licensing requirements?

- Does timeline accommodate 6-12 month approval?

Use case analysis:

- Does the infrastructure model cover your requirements?

- Are there use cases requiring direct authorisation?

- Will regulatory limitations affect product roadmap?

Operational capacity:

- Can you maintain ongoing reporting?

- Is audit capability available?

- Are compliance systems in place?

Timeline priority:

- Is time to market critical?

- Can product validation wait for licensing?

- Does competition require speed?

Infrastructure route works for most AIS open banking use cases. Direct licensing becomes relevant for specific business models or scale.

Common Mistakes

| Mistake | Why It Matters | Better Approach |

|---|---|---|

| Assuming license is mandatory | Delays launch unnecessarily | Evaluate infrastructure model first |

| Underestimating ongoing burden | Compliance operations consume resources | Model total cost over 3 years |

| Ignoring capital requirements | Cash flow impact | Compare infrastructure pricing |

| Starting build before clarity | Rework if regulatory model changes | Clarify approach before development |

| Treating as one-time decision | Switching later is complex | Consider long-term implications |

Founders often optimize for perceived regulatory safety. In practice, infrastructure model reduces early friction for most use cases

What I Feel About AISP Licensing Decisions

After working with UK fintech founders evaluating AISP license decisions, patterns emerge consistently.

Many founders assume they need a license immediately. In practice, licensing makes sense only at a certain scale or for specific business models.

The application cost is the smallest component. Ongoing governance, reporting, audit, and compliance operations matter more than initial approval.

Infrastructure-first approach often reduces early friction. Platforms validate product-market fit using FCA-authorised infrastructure. Then evaluate direct licensing when scale justifies regulatory investment.

Some founders treat licensing as a credibility signal. In practice, investors evaluate business model viability more than regulatory status at an early stage.

Architecture decisions compound over time. Platforms choosing direct licensing commit to regulatory operations for years. The infrastructure model provides optionality to license later if the business model requires it.

The regulatory landscape evolves. FCA expectations change. Platforms maintaining direct authorisation adapt continuously. Infrastructure providers handle these changes at scale.

No universal answer exists. Decision depends on business model, resources, timeline, and strategic positioning.

What is an AISP license?

An AISP license is FCA authorisation allowing Account Information Service Providers to access customer bank account data with consent under UK Open Banking regulations.

Do you need an AISP license to access bank data?

Platforms can access bank data through FCA-authorised infrastructure without direct licensing. Direct AISP license is required only for becoming a regulated Account Information Service Provider.

How long does an AISP license application take?

FCA AISP license applications typically take 6-12 months from submission to approval, depending on application completeness and FCA review queue.

What does AISP open banking enable?

AISP open banking enables read-only access to customer bank account data including transaction history, balances, and account details with customer consent.

Can you operate without becoming an AISP?

Platforms can access AIS open banking capability through FCA-authorised infrastructure providers without becoming directly authorised AISP themselves.

See how Finexer’s FCA-authorised infrastructure enables bank data access for product development.