Table of Contents

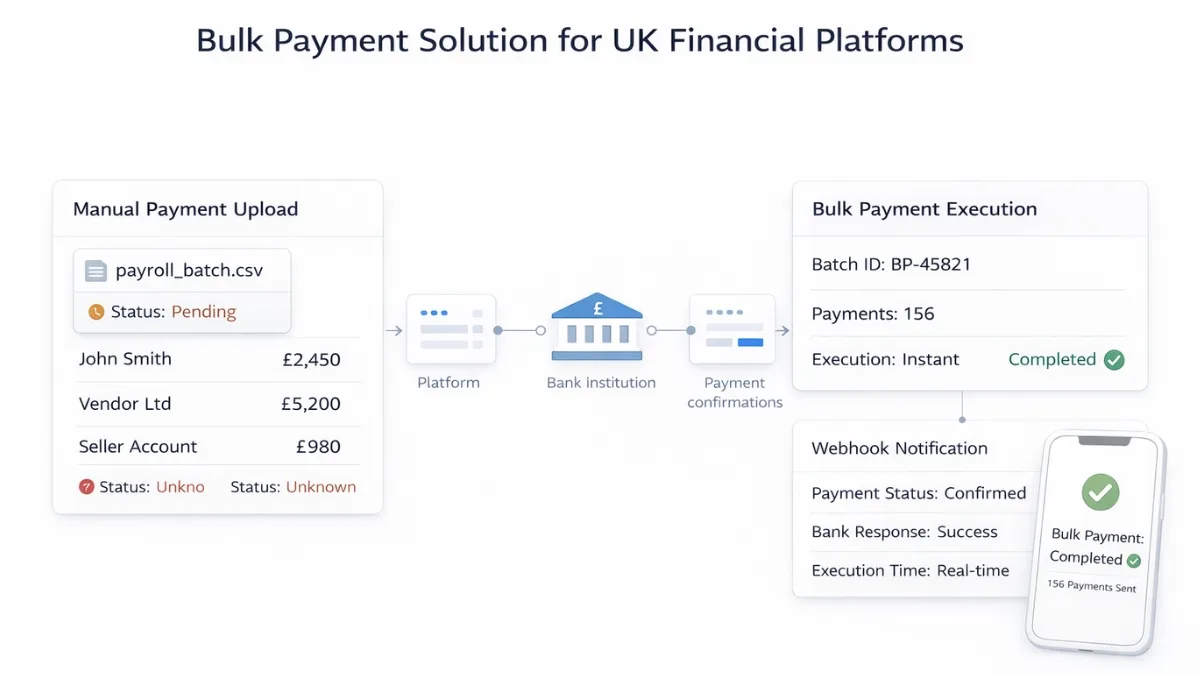

Platforms sending multiple payments daily face operational bottlenecks. Payroll runs, vendor payouts, and marketplace settlements require reliable bulk payment solution infrastructure that removes manual file uploads and reduces execution delays.

Key Takeaways

What problem does this solve?

Platforms cannot scale bulk payments when relying on manual CSV uploads and fragile banking workflows that create delays and errors.

Why does infrastructure matter?

Direct bank connectivity enables automated payment initiation. Platforms control execution timing and reduce operational workload without manual intervention.

What breaks when using legacy methods?

Manual file uploads create processing delays, increase error rates, and require constant team oversight during payment runs.

What should UK platforms prioritise?

FCA-authorised payment infrastructure that connects directly to banks and enables automated bulk payment initiation with status tracking.

Where does Finexer fit operationally?

Finexer provides payment initiation infrastructure. Platforms build payout logic, scheduling workflows, and user interfaces on top.

Why do platforms struggle with bulk payments?

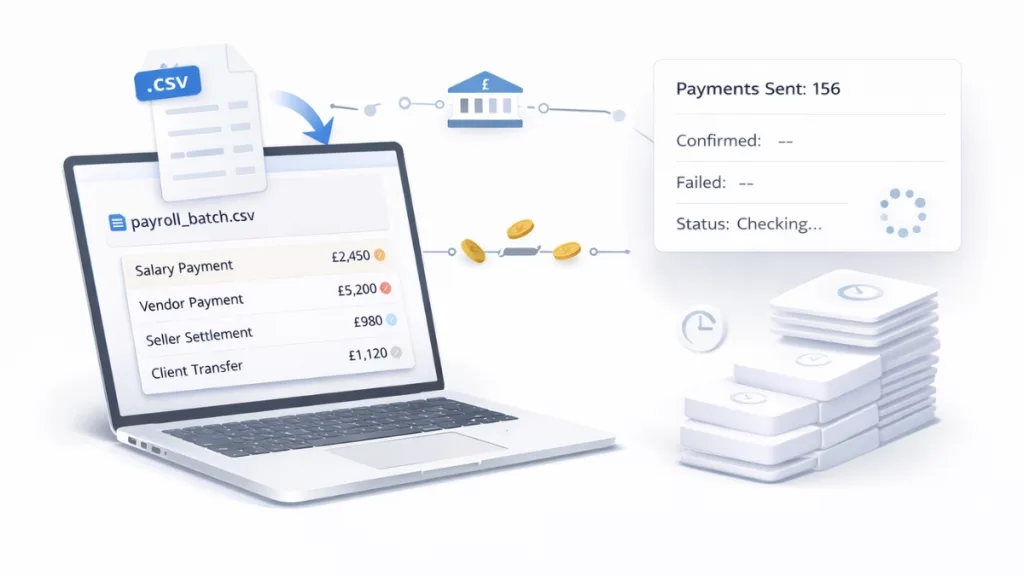

Payroll platforms send hundreds of salary payments monthly. Accounting software processes vendor payouts. Marketplaces handle seller settlements. Law firms transfer client funds.

When bulk payment solution infrastructure is absent, teams upload CSV files manually to banking portals. This creates execution delays during critical payment runs.

Payment confirmation becomes unclear. Finance teams cannot verify which payments executed successfully without checking bank statements hours later.

Scaling becomes difficult. Adding more payment volume requires hiring operations staff to manage manual uploads and reconciliation work.

What happens when bulk payments fail?

Payment delays damage platform credibility. Employees miss salary deposits. Vendors complain about late payments. Marketplace sellers lose trust.

Operational costs increase. Teams spend hours uploading payment files, checking execution status, and reconciling bank statements against platform records.

Error rates rise. Manual CSV preparation introduces formatting mistakes that cause payment rejections or incorrect amounts being sent.

Regulatory risk increases. Platforms handling client money without proper payment tracking face scrutiny during compliance reviews.

What infrastructure prevents these failures?

Platforms need direct bank connectivity that enables automated payment initiation. Each bulk payment should execute without manual file uploads to banking portals.

Payment status tracking must be automated. Platforms need confirmation when payments execute successfully or fail, without checking bank statements manually.

Execution timing must be controllable. Platforms should initiate payments programmatically based on business logic, not manual scheduling.

Bank account verification should happen before payment initiation. Platforms need to confirm recipient account details are valid before attempting transfers.

According to UK Finance guidance on payment systems, platforms processing bulk payments must maintain proper audit trails and execution records.

How does Finexer solve bulk payment problems?

- Finexer provides FCA-authorised Open Banking infrastructure that enables platforms to initiate bulk payments directly from connected bank accounts, covering ~99% of UK banks including Lloyds, Barclays, Monzo, and Starling.

- Payment initiation happens through secure bank connections, allowing platforms to send multiple payments without manual CSV uploads or logging into banking portals.

- Real-time webhooks provide payment status updates, confirming whether payments are successful, failed, or pending.

- Account verification infrastructure validates recipient details before payment initiation, reducing failures caused by incorrect account numbers or sort codes.

- Historical payment data remains accessible for reconciliation, allowing platforms to reconstruct complete payment records without downloading manual bank statements.

- Integration support is provided during onboarding, while platforms remain responsible for building payout scheduling logic, user interfaces, and business workflows on top of the infrastructure.

For platforms managing bulk payment processing workflows, direct bank connectivity removes operational bottlenecks that slow down payment execution.

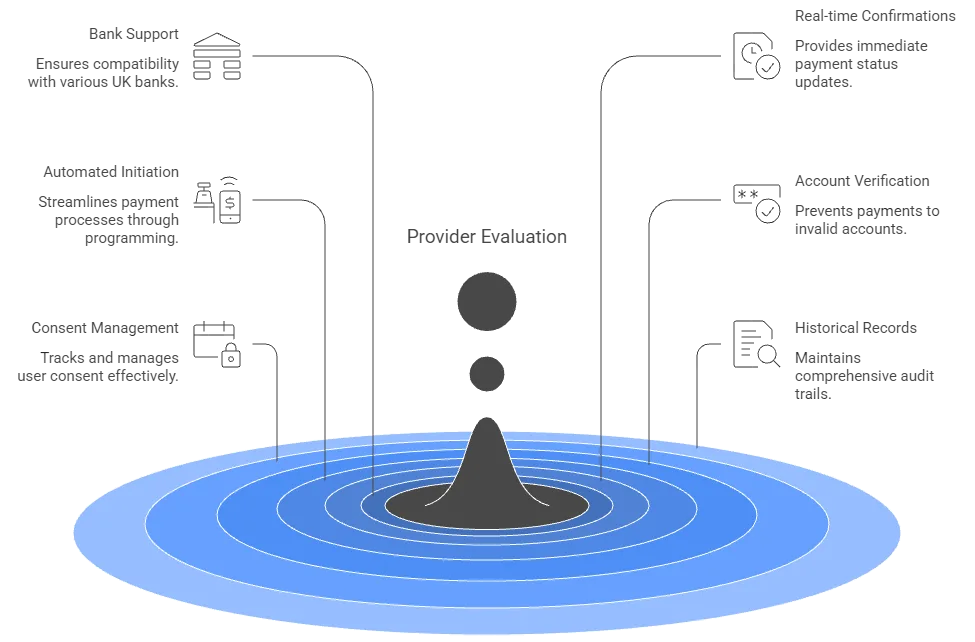

What should platforms check when evaluating providers?

Does the provider support all major UK banks? Incomplete coverage creates limitations when clients use different banking providers.

Are payment confirmations available in real-time? Delayed status updates prevent platforms from confirming successful execution during critical payment runs.

Can payment initiation be automated programmatically? Manual processes defeat the purpose of infrastructure investment.

Is account verification available before payment? Sending payments to invalid accounts creates reconciliation problems and customer complaints.

Does the provider handle consent management properly? Platforms need automated consent tracking with clear expiry management.

Can platforms access historical payment records? Short retention periods create gaps in audit trail documentation.

Platforms building payment infrastructure should confirm that bank connectivity includes all necessary features for automated bulk payment solution deployment.

Common Infrastructure Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Relying on manual CSV uploads | Creates operational bottlenecks that prevent scaling | Direct bank connectivity with automated payment initiation |

| Using screen scraping for payments | Fragile connections break frequently, causing payment failures | FCA-authorised Open Banking infrastructure |

| Skipping account verification | Invalid recipient details cause payment failures | Pre-payment account verification capabilities |

| Choosing providers without status webhooks | Platforms cannot confirm execution without manual checking | Real-time payment status notifications |

| Selecting providers with limited bank coverage | Clients using unsupported banks cannot use platform features | 99% UK bank coverage including challengers |

Platforms managing bulk payouts should prioritise infrastructure that provides reliable execution without manual intervention.

What I Feel

Most platforms underestimate the operational cost of manual bulk payment processing. Teams spending hours on CSV uploads and reconciliation work create hidden costs that compound as payment volume grows.

The mistake I see most often is choosing infrastructure that requires manual intervention during payment runs. This defeats the automation benefit that platforms are paying for.

Cheap solutions that rely on screen scraping create fragile connections. When payment execution fails during critical payroll runs, platforms face immediate credibility damage with clients.

Platforms serving businesses with time-sensitive payment needs should treat bulk payment solution infrastructure as operational reliability investment, not technical feature addition.

The scaling benefit comes from automation. Platforms that eliminate manual payment processing can handle 10x payment volume without proportional operations team growth.

What is a bulk payment solution for platforms?

A bulk payment solution enables platforms to initiate multiple payments programmatically through direct bank connections, removing manual CSV uploads and banking portal access.

Why do platforms need dedicated payment infrastructure?

Manual payment processing creates operational bottlenecks that prevent scaling. Direct bank connectivity enables automated execution without team intervention.

Can platforms build payment infrastructure internally?

Platforms can build business logic and workflows, but bank connectivity requires FCA authorisation. Most platforms use authorised infrastructure providers rather than applying for payment licenses.

How do bulk payments differ from single payments?

Bulk payments involve sending multiple transfers in coordinated batches. Infrastructure must handle volume efficiently without manual processing for each transaction.

What makes Open Banking bulk payments different from traditional methods?

Open Banking provides direct bank connectivity with automated initiation and status tracking. Traditional methods require manual file uploads and lack real-time confirmation.

Automate bulk payment execution with bank-verified infrastructure.