Table of Contents

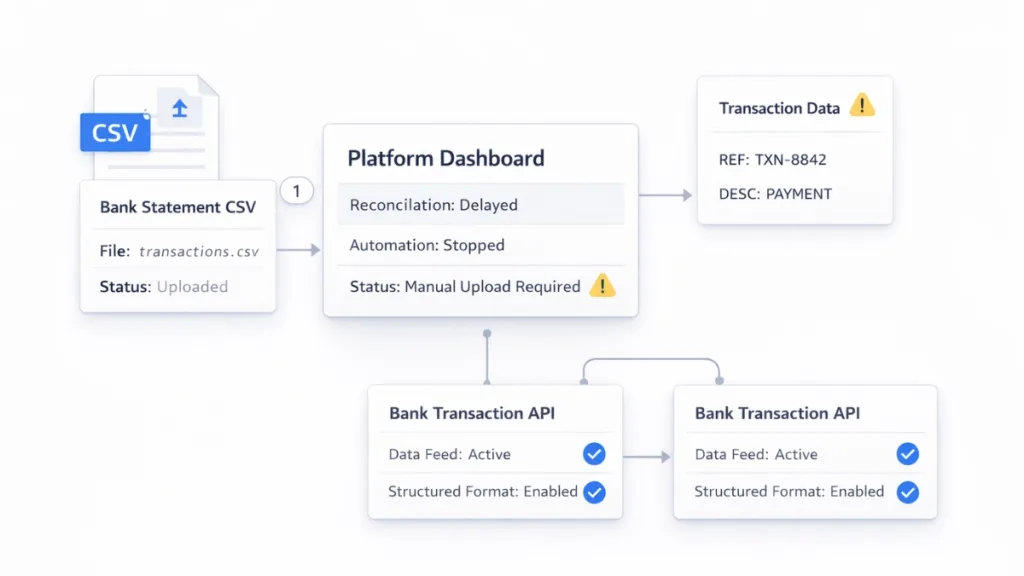

Manual CSV Imports Break at Scale

Product teams building UK platforms face the same problem. Manual CSV imports delay reconciliation. Authentication tokens expire frequently. Bank coverage gaps affect user experience. Data inconsistencies break matching logic.

When transaction volumes grow, manual processes fail. API for bank transactions becomes an infrastructure requirement, not an optional feature.

Key Takeaways

Do you really need your own AISP licence?

Most platforms access bank data through FCA-authorised infrastructure without direct licensing. Direct authorisation required only for specific business models.

Are you evaluating coverage or just API docs?

UK bank coverage percentage determines whether users can connect accounts. Documentation quality matters less than actual bank support depth.

Is structured data more important than speed?

Fast API integration without consistent data format creates reconciliation problems later. Structured transaction data enables reliable matching logic.

What happens when tokens expire frequently?

Poor consent lifecycle management requires users to reconnect repeatedly. Infrastructure should handle token refresh automatically.

Are you thinking about month-end workflows?

Batch-only data feeds delay month-end close. Real-time transaction access via webhooks enables faster reconciliation.

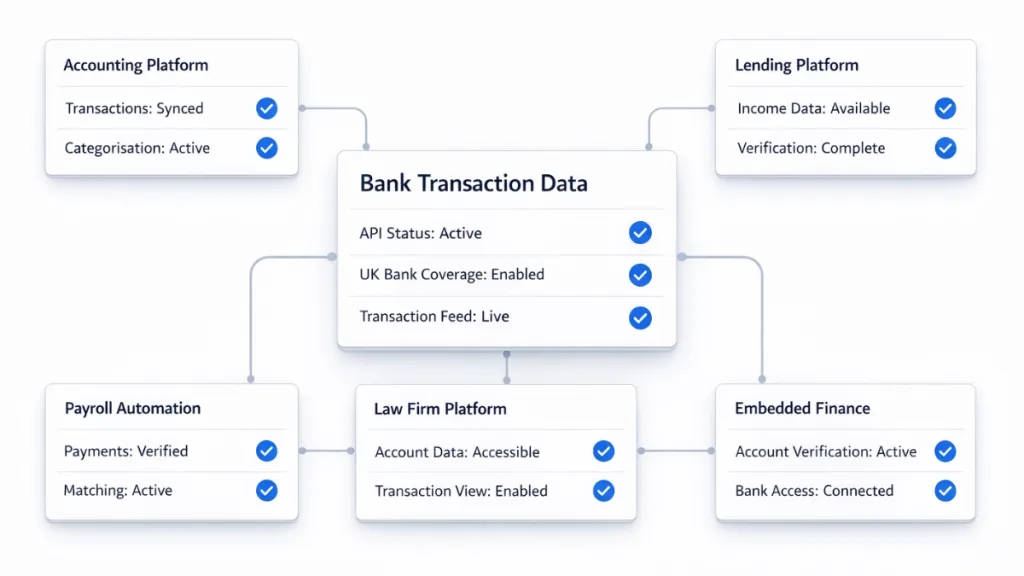

Who Needs This

- UK accounting SaaS platforms: Transaction categorisation requires bank data feeds

- Lending platforms: Income verification needs bank transaction analysis

- Payroll automation tools: Salary payment verification requires transaction matching

- Law firm platforms: Client account validation needs transaction visibility

- Embedded finance products: Account verification before payouts requires bank data access

These platforms cannot function without reliable api to get bank transactions from UK banks.

The Problem: Manual Bank Data Access

Traditional approach breaks product workflows:

Manual CSV imports:

- Users download bank statements

- Upload files to platform

- Repeat monthly

- Manual process does not scale

Authentication expiry:

- Screen-scraping connections break

- Users reconnect accounts repeatedly

- Support tickets increase

- User experience suffers

Coverage gaps:

- Major banks only supported

- Challenger bank users cannot connect

- Building societies missing

- User adoption limited

Data inconsistencies:

- Each bank formats differently

- Matching logic breaks

- Reconciliation requires manual intervention

- Month-end close extends

Product teams cannot build reliable features without consistent bank data access.

Understanding banking API integration requirements helps technical teams evaluate infrastructure needs.

Business Impact When Infrastructure Fails

When bank transaction access is unreliable:

Reconciliation delays:

- Finance teams wait for transaction data

- Month-end close extends beyond deadlines

- Cash flow visibility lags

- Reporting accuracy suffers

Support load increases:

- Users report connection failures

- Manual reconnection required

- Feature functionality questioned

- Platform reputation damaged

Compliance pressure grows:

- Audit trails incomplete

- Transaction verification manual

- Regulatory reporting delayed

- Risk exposure increases

Product trust erodes:

- Promised automation fails

- Users revert to manual processes

- Churn increases

- Feature adoption stalls

The infrastructure decision affects product reliability directly.

Various bank transaction API examples show how different providers approach these problems.

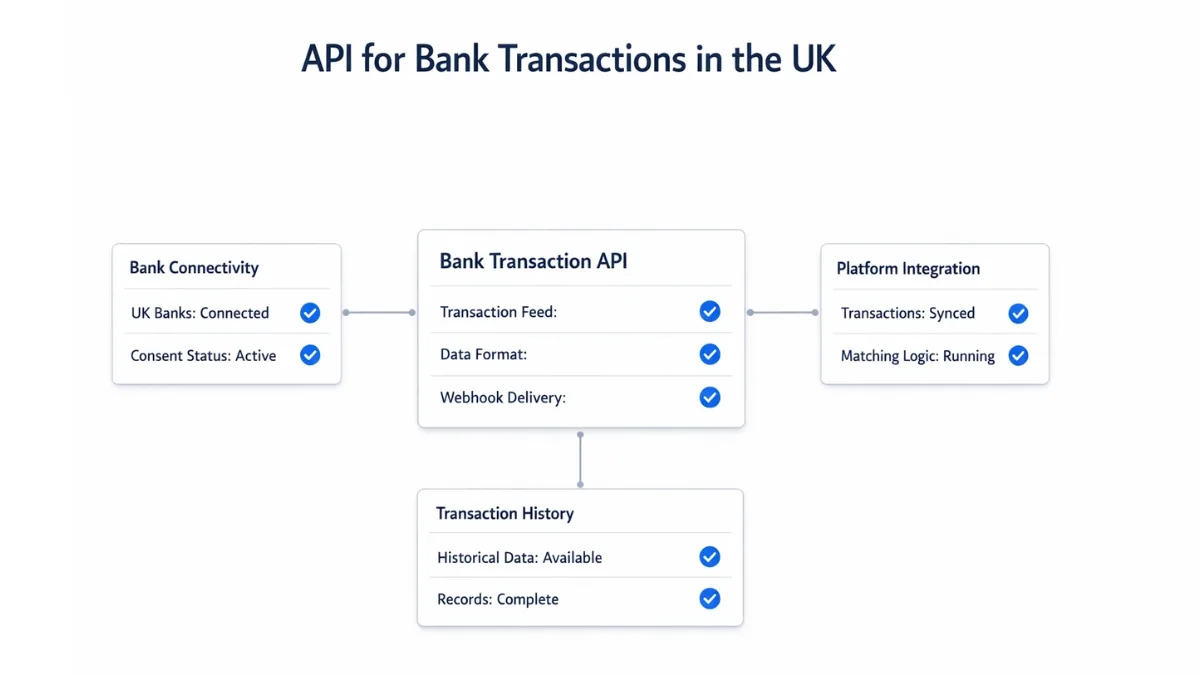

What to Check in API for Bank Transactions

Before choosing infrastructure:

UK bank coverage depth:

- Percentage of UK banks supported

- Challenger bank inclusion (Monzo, Starling, Revolut)

- Building society access

- Verification through actual testing

Historical data availability:

- How far back transactions accessible

- Data completeness for past periods

- Account history depth

- No gaps in records

Structured transaction enrichment:

- Consistent format across banks

- Transaction categorisation quality

- Merchant name normalisation

- Metadata completeness

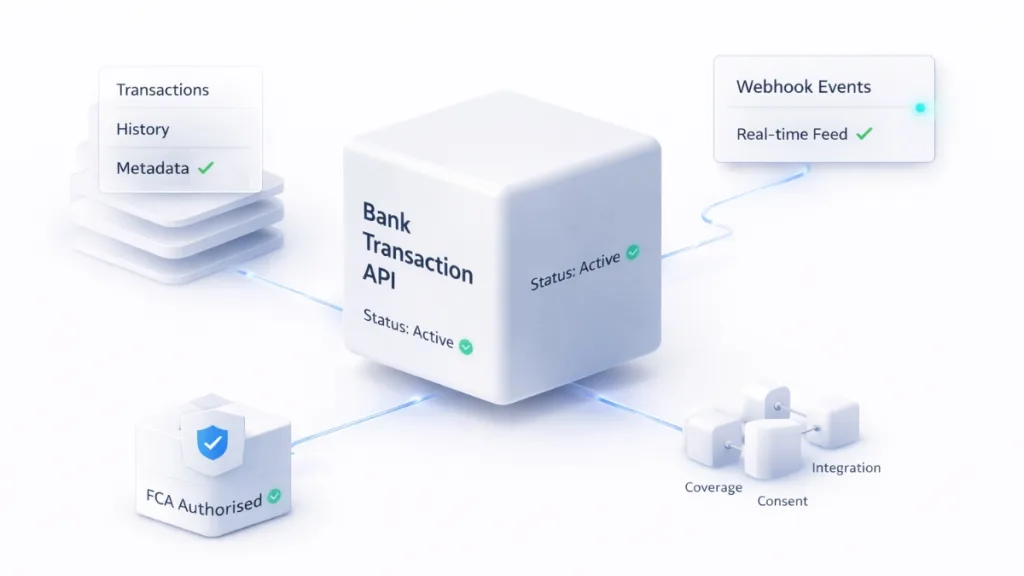

Webhook support:

- Real-time transaction notifications

- Status update delivery

- No polling required

- Event coverage completeness

Consent management:

- Token refresh automation

- Expiry handling

- User notification system

- Reconnection flow quality

FCA-authorised infrastructure:

- Regulatory compliance status

- Direct Open Banking connectivity

- No screen-scraping risk

- Audit trail availability

Pricing transparency:

- Usage-based vs fixed contracts

- Per-transaction costs clear

- No hidden integration fees

- Volume commitment requirements

Following an Open Banking API integration guide reveals evaluation criteria beyond documentation.

Evaluation Framework

| Evaluation Factor | Why It Matters | Risk If Ignored |

|---|---|---|

| UK bank coverage | Users cannot connect accounts | Adoption limited to major bank customers |

| Data consistency | Matching logic breaks | Manual reconciliation required |

| Historical depth | Past period reconciliation fails | Incomplete records |

| Webhook delivery | Real-time features impossible | Batch delays |

| Consent handling | Users reconnect repeatedly | Poor experience, support tickets |

| FCA authorisation | Regulatory risk | Compliance exposure |

Infrastructure determines whether features work reliably. API documentation quality matters less than operational reliability.

Where Finexer Fits

Finexer provides FCA-authorised infrastructure for accessing UK bank transactions.

We handle bank connectivity. Platforms focus on product features.

How Finexer solves bank data access problems:

- Problem: Users cannot connect challenger bank accounts

Finexer provides: Access to UK banks including challengers and building societies

Platform result: Users connect accounts regardless of banking provider

- Problem: Transaction data format varies by bank

Finexer provides: Structured transaction data in consistent format

Platform result: Single matching algorithm works across all banks

- Problem: Manual CSV imports delay reconciliation

Finexer provides: Real-time transaction feeds via webhooks

Platform result: Automated import eliminates manual uploads

- Problem: Authentication expires requiring reconnection

Finexer provides: Consent lifecycle management with automatic refresh

Platform result: Users stay connected without manual intervention

- Problem: Historical data gaps prevent past reconciliation

Finexer provides: Transaction history access up to 7 years

Platform result: Complete records for analysis and audit

Infrastructure specifics:

- FCA-authorised Open Banking access

- Connection to UK banks

- Structured transaction data format

- Real-time webhook notifications

- Historical data retrieval

- Consent lifecycle automation

- 3-5 weeks integration support

- Usage-based pricing per API call

This is infrastructure enabling features. Platforms build categorisation, reconciliation, and reporting users see.

Comprehensive Open Banking API guides explain technical architecture beyond marketing claims.

Common Infrastructure Selection Mistakes

| Mistake | Why It Breaks | Better Approach |

|---|---|---|

| Evaluating docs only | Real bank support varies | Test with actual banks |

| Ignoring data structure | Integration works, features break | Verify transaction format |

| Accepting batch feeds | Real-time impossible | Require webhook support |

| Limited bank testing | User banks unsupported | Verify coverage thoroughly |

| Speed over stability | Quick integration, long maintenance | Evaluate reliability |

Product teams often optimize for integration timeline. Then spend months fixing reliability issues infrastructure should handle.

What I See in Practice

After working with UK product teams evaluating api for bank transactions, patterns emerge consistently.

Most teams struggle not with API integration. They struggle with data consistency and coverage depth after integration completes.

Teams assume all providers support all UK banks. In practice, coverage varies significantly. Challenger bank support separates infrastructure providers.

Documentation quality misleads. Well-documented APIs with poor bank coverage create worse outcomes than adequate documentation with comprehensive coverage.

Transaction data structure matters more than initial integration speed. Platforms spending extra weeks choosing infrastructure with consistent data format save months fixing matching logic later.

Real-time webhooks transform product capability. Platforms limited to batch feeds cannot build features users expect. The infrastructure decision determines the feature roadmap.

Consent lifecycle automation affects user experience dramatically. Infrastructure requiring manual reconnection generates support tickets continuously.

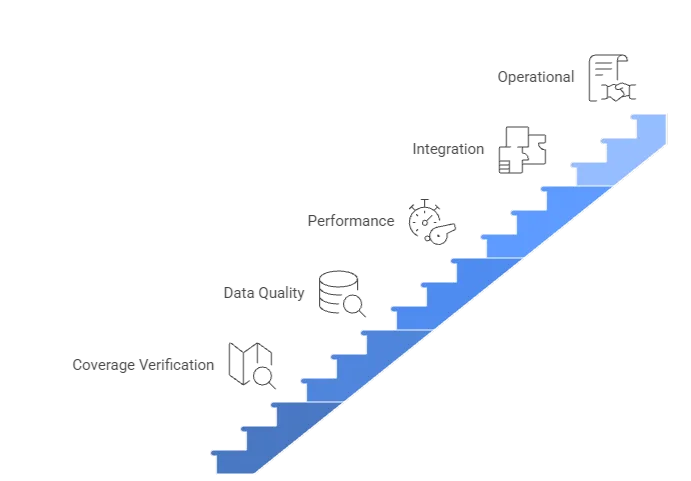

Technical Requirements Checklist

When evaluating api to get bank transactions:

Coverage verification:

- Request complete UK bank list

- Test connections with actual banks

- Verify challenger inclusion

- Check building society support

Data quality:

- Review transaction format

- Test categorisation accuracy

- Verify merchant normalisation

- Check metadata completeness

Performance:

- Measure webhook delivery time

- Test historical data retrieval

- Verify API response times

- Check error handling

Integration:

- Review documentation clarity

- Test sandbox environment

- Validate webhook configuration

- Assess onboarding support

Operational:

- Understand pricing structure

- Verify contract terms

- Check support availability

- Review SLA commitments

Infrastructure evaluation determines long-term product success.

What is an API for bank transactions?

An API for bank transactions provides programmatic access to customer bank account transaction data through FCA-authorised Open Banking connectivity.

How do platforms access UK bank transactions?

Platforms integrate api to get bank transactions through FCA-authorised infrastructure providers offering Open Banking connectivity to UK banks.

Do you need AISP licence for bank transaction API?

Platforms can access bank transaction data through FCA-authorised infrastructure without direct AISP licensing. Infrastructure provider holds authorisation.

What data does the bank transaction API provide?

API for bank transactions provides transaction history, dates, amounts, merchant details, categories, and account balances with customer consent.

How long does bank transaction API integration take?

Integration with api for bank transactions typically takes 3-5 weeks including consent flow implementation, webhook configuration, and testing.

See how Finexer’s infrastructure enables reliable bank data access for product features