Table of Contents

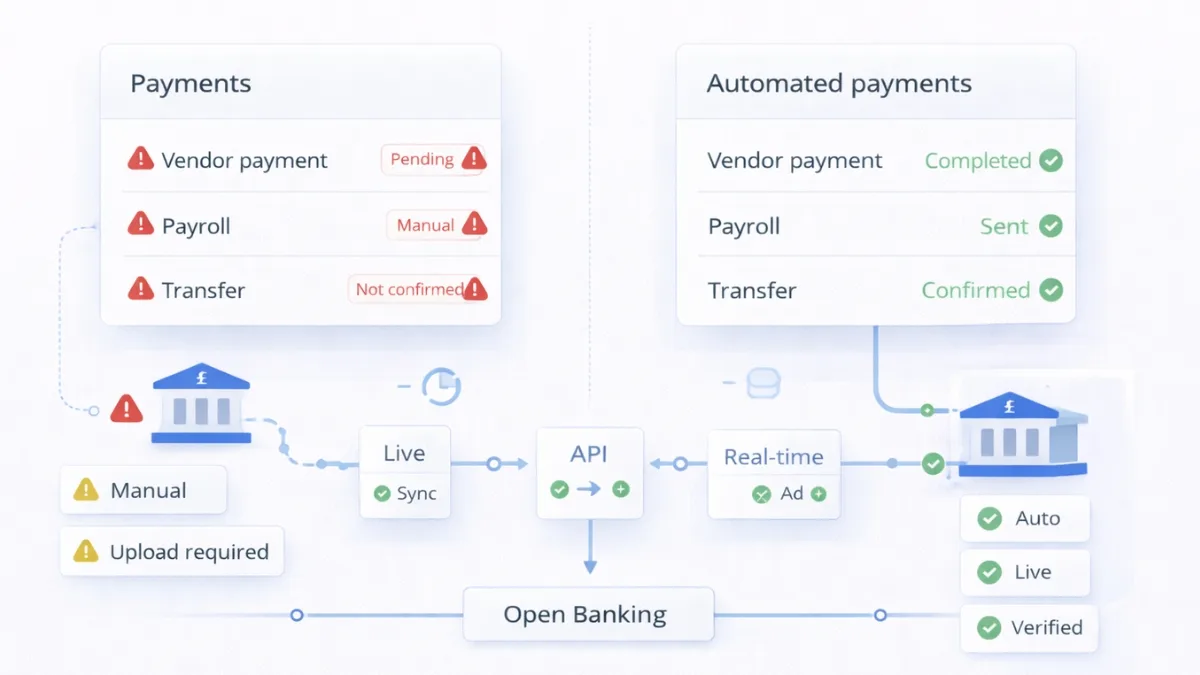

UK platforms cannot scale when B2B payment automation depends on manual bank transfers and CSV uploads. Business users expect automated payment execution without logging into banking portals separately.

Key Takeaways

What problem does this solve?

Platforms cannot automate B2B payments UK when users must initiate bank transfers manually through separate banking portals.

Why does infrastructure matter?

Direct bank connectivity enables automated payment initiation. Platforms control execution timing without requiring manual user intervention.

What breaks with manual processes?

Payment delays increase. Reconciliation becomes manual. Operational costs grow. Users abandon platforms requiring too many manual steps.

What should UK platforms prioritise?

FCA-authorised payment infrastructure enabling automated B2B payment automation through open banking with real-time status tracking.

Where does Finexer fit operationally?

Finexer provides payment initiation infrastructure. Platforms integrate once and enable B2B payments UK through APIs. Platforms build scheduling logic and workflows on top.

Why does B2B payment automation fail?

Platforms promise automated vendor payments, payroll execution, and marketplace settlements. These features require direct payment initiation capability.

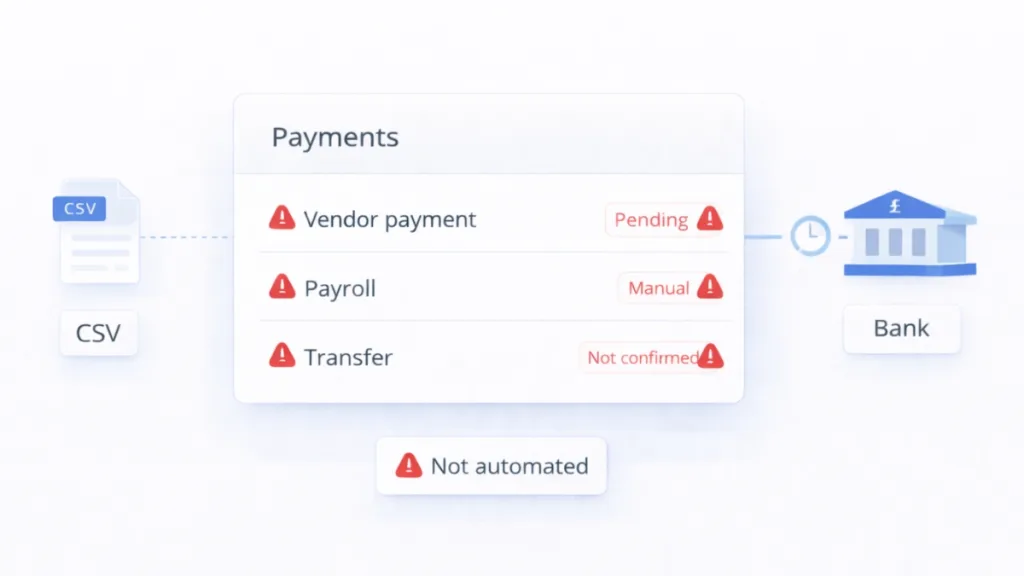

Current manual processes:

- Finance teams log into banking portals separately

- CSV files get uploaded for bulk payments

- Payment confirmations arrive hours later

- Reconciliation happens manually against platform records

- Users repeat processes for every payment run

When platforms lack payment infrastructure, users cannot execute B2B payments UK directly from the platform. They download payment files, upload to banks, then confirm execution manually.

Manual bank transfers create timing uncertainty. Platforms cannot guarantee when payments execute. Users check banking portals separately to confirm status.

Reconciliation delays extend month-end close. Finance teams match bank statements against platform records manually because automated feeds are absent.

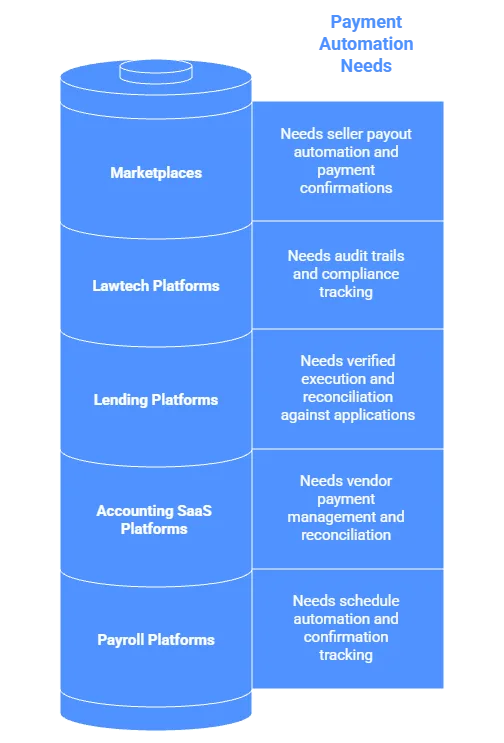

Who needs B2B payment automation infrastructure?

Different platforms face specific payment challenges:

Accounting SaaS platforms:

- Users manage vendor payments for multiple clients

- Manual transfers require separate bank logins

- Reconciliation becomes time-consuming at scale

Payroll platforms:

- Salary payments execute on fixed schedules

- Manual processing delays payment runs

- Confirmation tracking happens outside platform

Lending platforms:

- Loan disbursements require verified execution

- Manual transfers create disbursement delays

- Reconciliation against applications is manual

Lawtech platforms:

- Client account payments need audit trails

- Manual bank transfers lack proper tracking

- Compliance requires verified execution records

Marketplaces:

- Seller payouts happen on schedules

- Manual processing prevents scaling

- Payment confirmations arrive delayed

What happens when payment automation fails?

Business impact appears immediately:

Operational delays:

- Payment runs take hours instead of minutes

- Finance teams spend time on manual uploads

- Month-end close extends unnecessarily

User experience problems:

- Users expect one-click payment execution

- Platform requires multiple manual steps

- Competitive platforms offer better automation

Reconciliation overhead:

- Teams match statements manually

- Payment confirmations arrive separately

- Audit trails remain incomplete

Scaling limitations:

- Manual processes prevent volume growth

- Support costs increase with user numbers

- Operational margins compress

Compliance risks:

- Payment audit trails contain gaps

- Execution timing cannot be verified

- Client money handling lacks proper tracking

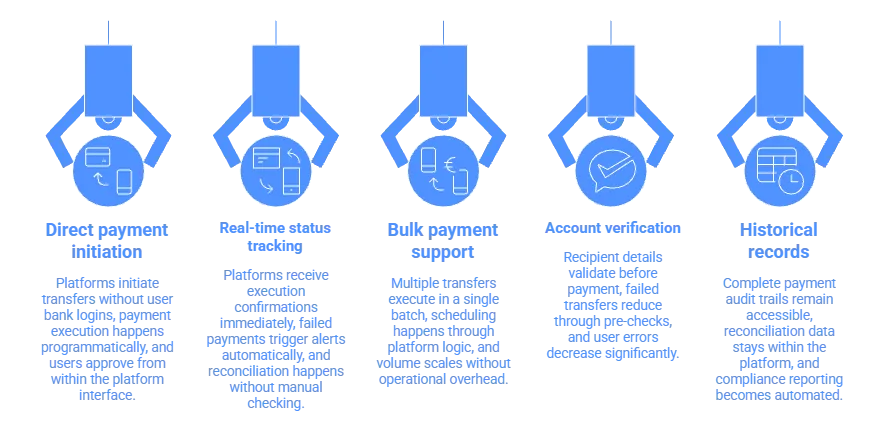

What infrastructure enables payment automation?

Platforms need specific capabilities for B2B payment automation:

According to UK financial regulations, platforms handling B2B payments UK must maintain proper audit trails and execution records.

How does Finexer enable B2B payment automation?

Finexer provides FCA-authorised payment infrastructure for UK platforms.

Key capabilities:

- 99% UK bank coverage

- FCA-authorised infrastructure

- Real-time webhooks

- Up to 7 years historical data

- Usage-based pricing

- White-label ready

- 2-3x faster integration

- 3-5 weeks onboarding support

- Saves up to 90% on transaction costs

How payment automation works:

Platforms integrate payment APIs once. Users authenticate bank accounts through secure open banking flows. Platforms initiate payments programmatically without requiring separate bank logins.

Payment execution happens directly from connected accounts. Users approve transfers within platform interfaces. No CSV uploads or banking portal access needed.

Real-time webhooks confirm execution status immediately. Platforms know when payments succeed or fail. Reconciliation happens automatically against platform records.

Bulk payments execute efficiently through single API calls. Platforms schedule payroll runs, vendor payments, or marketplace payouts programmatically.

Account verification checks recipient details before payment initiation. Failed transfers reduce through validation. User experience improves significantly.

For platforms managing B2B payments through open banking, direct infrastructure removes operational bottlenecks.

Implementation checklist for platforms

Critical evaluation criteria:

Payment capabilities:

- Does infrastructure support bulk payment initiation?

- Are single payments and batch transfers both available?

- Can platforms schedule payments programmatically?

Status tracking:

- Do platforms receive real-time execution confirmations?

- Are webhook notifications reliable?

- Can failed payments be identified immediately?

Account verification:

- Does infrastructure validate recipient details?

- Are sort codes and account numbers checked?

- Do validation errors surface before payment?

Bank coverage:

- Are all major UK banks supported?

- Can users connect any business account?

- Are challengers and building societies included?

Authorisation:

- Is the provider FCA-authorised for payment initiation?

- What compliance protections exist?

- Are there regulatory risks?

Integration timeline:

- How quickly can platforms deploy?

- What support is provided during onboarding?

- Are timelines realistic for production launch?

Platforms building instant bank payment features should confirm infrastructure supports their use cases.

Common implementation mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Choosing batch-only solutions | Real-time payments become impossible | Infrastructure supporting both instant and scheduled transfers |

| Skipping account verification | Failed payments increase user frustration | Pre-payment validation of recipient details |

| Ignoring status webhooks | Platforms cannot confirm execution automatically | Real-time notifications for payment status |

| Limited bank coverage | Users cannot connect business accounts | 99% UK bank support including challengers |

| Using unauthorised providers | Creates compliance exposure for platforms | FCA-authorised payment infrastructure |

Platforms offering accounting and ERP integrations should ensure payment infrastructure supports their reconciliation workflows.

What we see in practice

Most platforms underestimate the complexity of maintaining payment infrastructure. Building direct bank integrations internally takes months per institution.

Common implementation realities:

- Payment confirmations arrive delayed without proper webhooks

- User authentication breaks requiring manual re-connection

- Failed payments go undetected without status tracking

- Reconciliation remains manual despite payment automation

- Support costs increase troubleshooting payment issues

The mistake we see most often is choosing payment infrastructure based on initial integration simplicity. Maintenance burden appears when payment volumes grow and edge cases emerge.

Platforms that scale successfully treat payment infrastructure as foundational capability. They focus engineering on business logic, scheduling workflows, and user experience rather than maintaining bank connectivity.

Account verification prevents most payment failures. Platforms validating recipient details before initiation see significantly lower error rates and better user satisfaction.

Real-time status tracking changes operational workflows. Finance teams identify failed payments immediately instead of discovering issues during reconciliation hours later.

For platforms requiring payment capabilities, reliable infrastructure removes operational overhead that prevents scaling.

Common use cases

Accounting platforms:

- Automate vendor payment execution for clients

- Enable one-click payment from invoice screens

- Reconcile payments automatically against records

Payroll platforms:

- Execute salary payments on schedules

- Confirm payment delivery in real-time

- Reconcile payroll runs automatically

Lending platforms:

- Disburse loans directly to borrower accounts

- Track payment execution automatically

- Reconcile disbursements against applications

Lawtech platforms:

- Process client account payments with audit trails

- Verify payment execution for compliance

- Maintain complete payment records

Marketplaces:

- Execute seller payouts on schedules

- Confirm payment delivery automatically

- Scale payment volumes without operational growth

What is a B2B payment system for platforms?

B2B payment automation infrastructure enables platforms to initiate business payments programmatically through open banking APIs. Users execute transfers without separate bank logins.

What are the top platforms for automating B2B payment transfers?

Platforms integrate payment infrastructure providers rather than building solutions themselves. FCA-authorised providers offer APIs for automated B2B payments UK execution.

What is payment automation for platforms?

Payment automation removes manual bank transfers by enabling programmatic payment initiation. Platforms control execution timing and receive real-time confirmations without user intervention.

How to automate a payment process?

Platforms integrate payment infrastructure APIs enabling direct bank connectivity. Users authenticate accounts once. Platforms initiate payments programmatically with real-time status tracking.

Why do platforms need B2B payment automation infrastructure?

Manual bank transfers prevent scaling. Users expect automated execution within platforms. Infrastructure enables B2B payment automation without operational overhead.

Replace manual bank transfers with automated B2B payment infrastructure and real-time execution tracking.