Category: Finexer-Open Banking

-

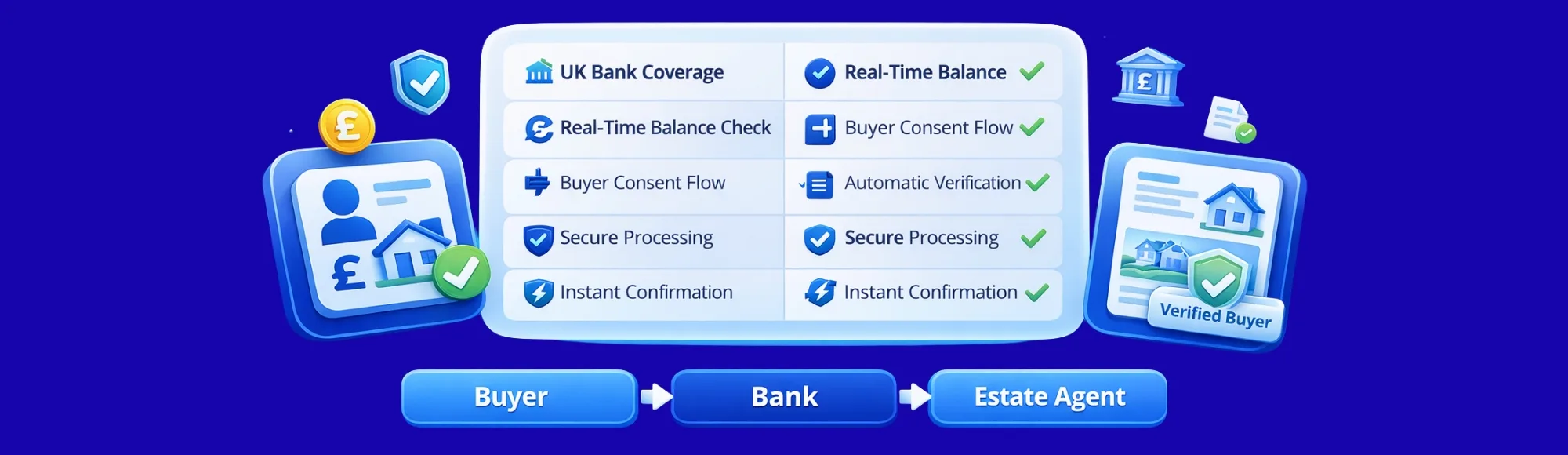

Real Estate Bank Verification: How Estate Agents Instantly Verify Proof of Funds & Bank Accounts Using Open Banking

Real estate bank verification for UK estate agents. Verify buyer funds instantly, eliminate statement delays & close deals faster with open banking technology.

-

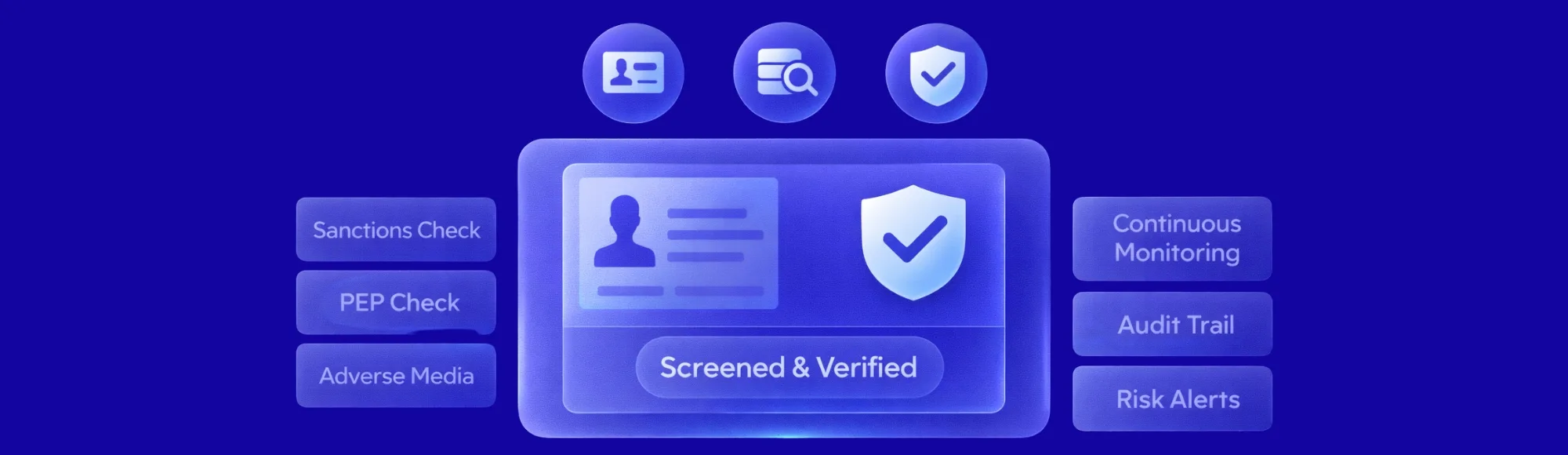

Automated AML Checks for Law Firms: How to Choose the Right Screening Solution

Automated AML checks for law firms reduce manual screening time by 90%. Real-time verification, continuous monitoring & complete audit trails with Finexer UK.

-

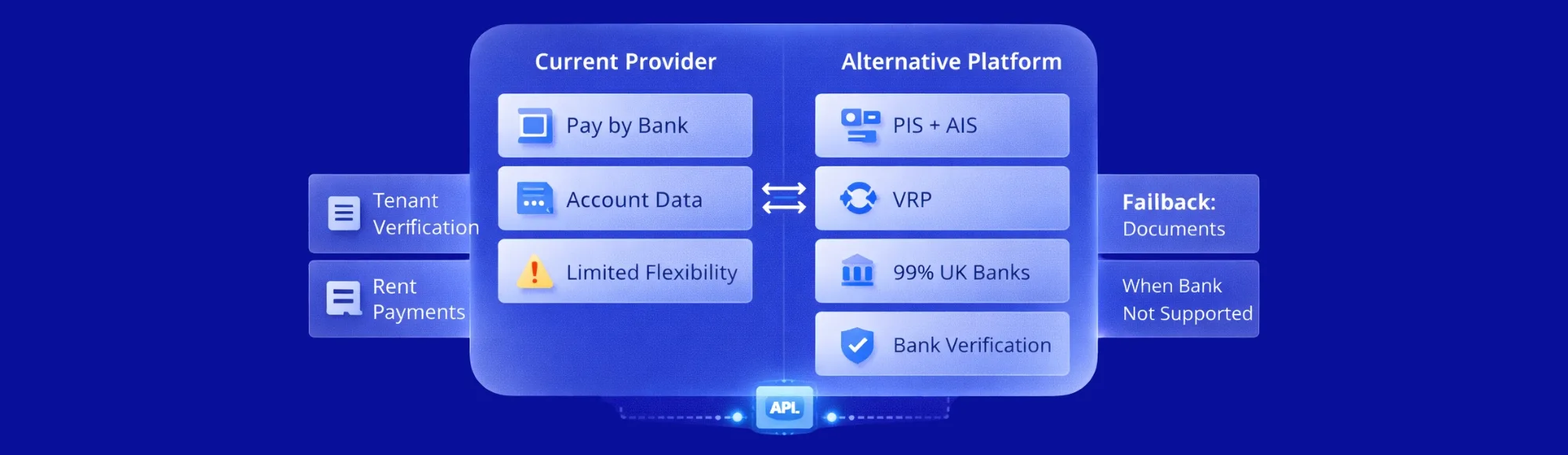

Switching from GoCardless Open Banking: UK Alternatives for Payments & Data APIs

Looking for GoCardless alternatives? Switch to Finexer for 99% UK bank coverage, VRP support, and complete migration assistance in 3-5 weeks

-

Looking for a Noda Open Banking Alternative? Compare UK Providers for Payment Initiation & Account Information Services

Looking for a Noda open banking alternative? Switch to Finexer for 99% UK bank coverage, faster deployment, and usage-based payments.

-

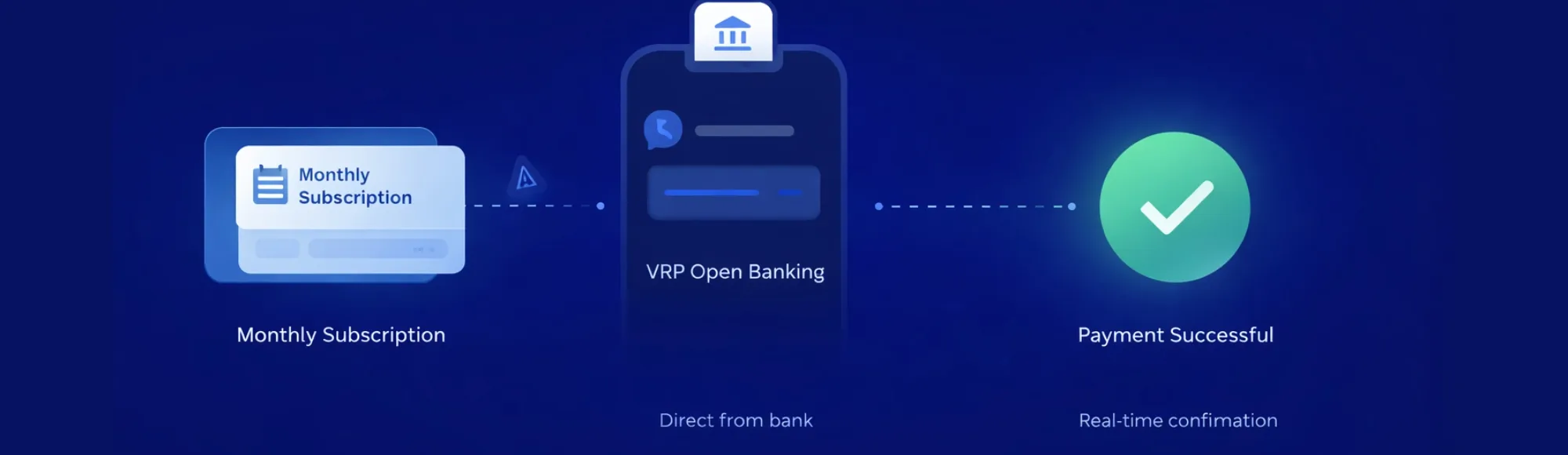

How VRP Payments Reduce Churn in UK Recurring Billing

Get VRP Payments with Finexer Cut churn, improve payment success & deploy faster with 99% UK bank coverage Contact Now Subscription businesses in the UK lose customers not because they want to leave, but because their payments fail. Card declines, expired details, and failed Direct Debits create friction that pushes customers away. Variable recurring payments…

-

Payment Links for UK Businesses: Accept Bank-to-Bank Payments Without Cards or Gateways

Accept pay-by-bank payment links via open banking. Cut card fees, get real-time settlement, and streamline UK payments with Finexer today online securely fast.

-

A2A Payments in the UK: Buyer Checklist for Choosing an Open Banking Provider

Learn how to choose the right A2A payments provider in the UK with this open banking buyer checklist covering bank coverage, pricing, success rates, and speed.

-

Free MTD Software for Landlords: What’s Actually Free and What Can Cost You Penalties

Free MTD software for landlords often misses key features. Discover what’s truly free, what triggers penalties, and how to stay compliant.

-

Detailed Guide to Brite Payments Alternatives in the UK

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now If you’ve explored open banking payment options for your business, chances are you’ve come across Brite Payments. Known for its instant account-to-account (A2A) transfers and frictionless checkout experience, Brite has made a name for itself across European…

-

Bulk Payment Processing: Save up to 90% on Transaction time in 2025

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now In today’s business world, manual payment processing isn’t just slow—it puts companies at a disadvantage. Finance teams across the UK spend countless hours handling transactions, losing valuable time with every payment cycle. Finexer’s bulk payment processing solution…

-

PayByBank: Get Paid Faster in 2025

Explore how PayByBank is revolutionising payments in 2025. Learn about its benefits, how it works, and why businesses should adopt this payment solution.

-

Faster B2B Payments in 2025 with Open Banking APIs

Learn how Open Banking APIs enable real-time transactions, reduce fees, and integrate seamlessly with your systems for secure, scalable payments in 2025

-

2025’s Low-Cost Online Payment Systems in the UK: Top 6

Online Payment Systems are digital platforms or services that enable businesses and individuals to process online transactions. These systems facilitate the secure and efficient transfer of funds from customers to merchants or service providers. Choosing the right online payment system is a critical decision for UK businesses. With transaction fees, ease of integration, and customer…

-

Truelayer Pricing for Startups in the UK 2025

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Note: The information about TrueLayer’s pricing and services in this article is based on research as of January 2025. What You Will Discover: The UK’s open banking sector has significantly changed how businesses interact with financial data…

-

Plaid Pricing for UK Startups 2025

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now Note: All pricing information comes from publicly available sources as of March 2025. What You Will Discover: Introduction In today’s financial technology sector, connecting banking data with applications forms the backbone of many modern financial services. Plaid,…

-

Most Affordable Open banking provider for Startups in UK

Get Paid with Finexer Connect with 99% of UK Banks and Scale Your Business without Limits Try Now What You Will Discover: How Open Banking Helps UK Startups and Small Businesses The landscape of business banking is changing rapidly, particularly for small businesses and startups in the UK. According to the latest data from January…

-

Top 3 Open banking platforms for fintech startups in the UK

What You Will Discover: How Open Banking Powers Fintech Startups? The United Kingdom stands at the forefront of financial innovation. Open banking has fundamentally changed how financial technology companies operate and serve customers. According to the Competition and Markets Authority’s 2023 report, the UK has surpassed 7 million active open banking users, marking a significant…

-

Open Banking Guide to Startups in the UK

In This Guide Current State of UK Open Banking The UK open banking sector continues to grow, with London leading Europe’s fintech development and £8.2 billion in investments last year1. This growth opens new opportunities for startups ready to enter the market. Open banking implementation directly impacts startup success. Companies with effective open banking solutions…

-

The Best Payments API for startups in the UK

What You Will Discover: Introduction The digital transformation wave has made payment processing a crucial cornerstone for UK startups, yet many founders navigate a complex landscape of payment infrastructure decisions. For startup leaders, choosing the right payment API isn’t just about processing transactions – it’s about laying a foundation that will support their business as…

-

Efficient Auditing with Open Banking Integration

What You Will Discover: According to a recent study by Accenture, open banking is expected to revolutionise the auditing industry, with 84% of banks planning to invest in API-driven solutions by 2025. As the auditing landscape evolves, the integration of open banking and modern APIs is emerging as a game-changer, transforming how auditors work and…

-

Get Paid Faster: Connect Xero with Finexer Payment Solutions

What You Will Discover: In today’s fast-paced business world, efficiency and automation are key to success. For accounting professionals, streamlining financial processes and reducing manual tasks can lead to significant time and cost savings. This is where the integration of Xero, a powerful cloud-based accounting software, with Finexer’s Open banking payment solution, comes into play.…

-

Free Accounting Software for Startups in the UK

What You Will Discover In today’s fast-paced business environment, choosing the right accounting software isn’t just about keeping books but building a foundation for growth. With the UK’s Making Tax Digital (MTD) initiative and evolving financial technology landscape, startups need cost-effective and future-ready solutions. Why Free Accounting Software Makes Sense for Startups The UK startup…

-

The Open Banking ROI: A Financial Impact Study

What You Will Discover Executive Summary As financial institutions increasingly embrace digital transformation, measuring the ROI of open banking has become crucial for strategic decision-making. Our comprehensive analysis shows that open banking ROI extends beyond mere cost savings, encompassing improved customer experiences, new revenue streams, and enhanced operational efficiency. This study dives deep into real-world…

-

Better Cash Flow Management with Open Banking

What You Will Discover Introduction In the fast-paced business world, effective cash flow management is not just a nice-to-have – it’s an absolute necessity. Cash flow is the lifeblood of any organisation, ensuring that you have the financial resources to meet your obligations, seize opportunities, and grow your business. Yet, for many companies, managing cash…

-

Mastering Expense Management Automation with Finexer’s API

What You Will Discover Introduction: In today’s fast-paced business world, efficient expense management is crucial for maintaining financial control, improving cash flow, and ensuring compliance with company policies and regulations. However, traditional manual expense management processes are often time-consuming, error-prone, and inefficient, leading to delays in reimbursements, reduced visibility into spending patterns, and potential fraud…

-

Finexer: Your Trusted Partner for Secure Open Banking Solutions

What You Will Discover Introduction Open banking has transformed the financial landscape, enabling third-party providers to access consumer banking data securely. However, with the increased sharing of sensitive information comes the responsibility to ensure robust security measures are in place. Finexer, as a leader in open banking, is committed to protecting your financial data while…

-

The Ultimate Guide to Variable Recurring Payments for UK Businesses

What You Will Discover Introduction If your business collects recurring payments from customers in the UK, you know the challenges of direct debits – high costs, failed payments, and a clunky customer experience. Fortunately, a new payment solution solves all these problems: Variable Recurring Payments (VRPs). In this guide, we’ll explain what VRPs are, how…

-

Guide to Real-Time Financial Data by Finexer

What You Will Discover In today’s fast-paced, data-driven business environment, making informed decisions quickly is more critical than ever to staying ahead of the competition. Real-time financial data access through APIs like Finexer’s Open Banking data can provide the insights you need to transform your business operations and drive success. In this post, we’ll explore…

-

Open Banking KYC: 85% Faster Business Verification

What You Will Discover Understanding Open Banking KYC In today’s fast-paced financial world, businesses face a critical challenge: verifying identities quickly and accurately while maintaining stringent compliance standards. Traditional Know Your Customer (KYC) processes, relying on manual document checking and lengthy verification procedures, have long been a bottleneck in business operations. However, a revolutionary approach…

-

Open Banking for Accountants

What You Will Discover Accounting firms stand at a pivotal crossroads in a world where digital transformation is reshaping every industry. Picture an accountant’s typical Monday morning: downloading countless CSV files, manually matching transactions, and spending hours reconciling accounts. Now, imagine those tasks happening automatically while they focus on strategic advisory services for their clients.…