Table of Contents

Pay by Invoice Workflows Still Rely on Cards or Manual Bank Transfers

Pay by invoice collection methods create operational friction for UK platforms. Card processing fees consume 2–3% per transaction. Manual bank transfer reconciliation requires finance team hours. Payment delays stretch cash flow.

Platforms offering invoice payment capabilities face identical problems. Customers request pay by invoice options. Then reconciliation overhead multiplies.

Key Takeaways

What operational risk does traditional pay by invoice create?

Card fees consume margins. Manual bank transfer reconciliation requires finance team intervention. Payment delays extend cash flow cycles beyond 30 days.

Why do invoice payment methods break at scale?

Reference matching fails without structured data. Multiple payment channels create reconciliation complexity. Manual intervention increases with transaction volume.

What should platforms prioritise when modernising pay an invoice workflows? Bank-to-bank transfer infrastructure, automated payment matching, real-time confirmation, usage-based pricing without percentage fees.

What breaks when choosing cheaper invoice payment providers? Limited bank coverage causes customer friction. Batch-only status updates delay reconciliation. Poor reference handling creates matching failures.

Where does Finexer fit operationally? FCA-authorised Open Banking infrastructure enabling instant bank transfers for pay by invoice workflows across 99% of UK banks.

Who Needs Better Pay by Invoice Infrastructure?

This article is for platforms if:

- You process B2B invoice payments

- You want to eliminate card processing fees

- You need faster payment confirmation

- You require automated reconciliation

- You operate in the UK market

If your platform handles recurring invoice payment methods or B2B transactions, payment infrastructure affects unit economics directly.

What Happens When Pay by Invoice Infrastructure Is Weak?

Traditional pay by invoice workflows create compound operational problems:

| Infrastructure Gap | Business Impact |

|---|---|

| Card-only payment acceptance | 2–3% fees on every transaction |

| Manual bank transfer reconciliation | Finance team hours matching payments |

| No payment reference standards | Failed automated matching |

| Batch-only status updates | Delayed reconciliation visibility |

| Limited bank coverage | Customer payment friction |

Card processing fees on invoice payments consume margins. A platform processing £100,000 monthly in invoices pays £2,000–£3,000 in card fees alone.

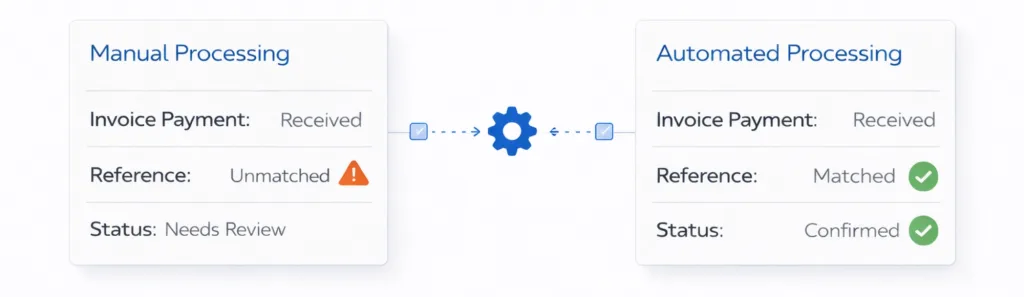

Manual bank transfer reconciliation requires finance teams to match payment references, contact customers for clarification, and update systems manually.

Why Invoice Payment Methods Need Bank-to-Bank Infrastructure

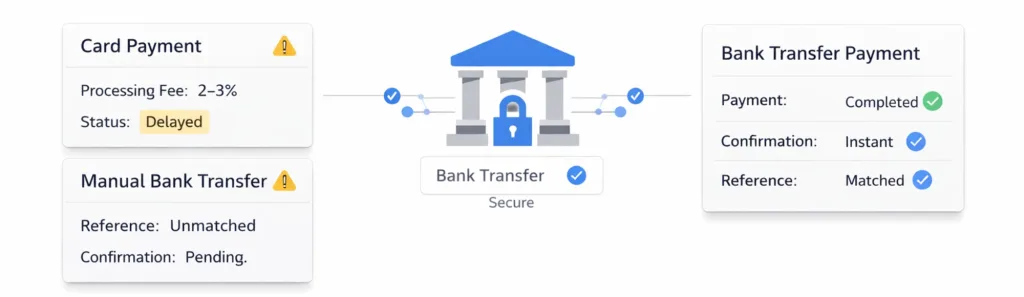

Traditional approaches rely on card rails or manual bank transfers. Both create friction:

Card processing for invoices:

- 2–3% transaction fees

- Chargeback risk

- Payment decline rates

- PCI compliance requirements

Manual bank transfers:

- Reference matching failures

- Multi-day reconciliation delays

- Customer confusion about payment instructions

- No real-time confirmation

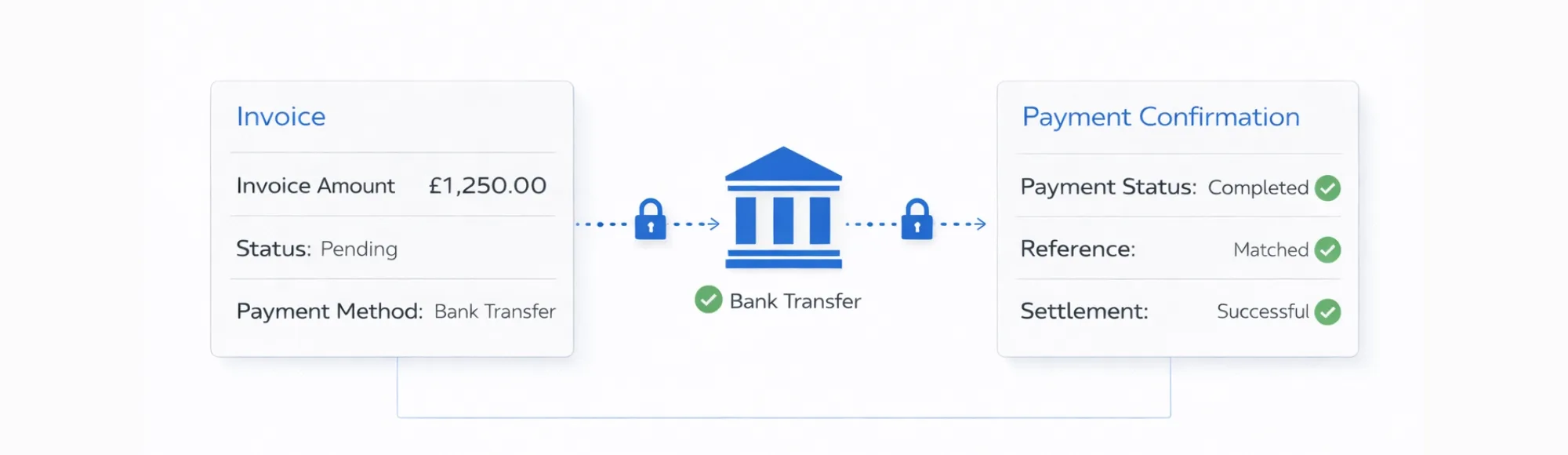

Modern pay by invoice infrastructure uses Open Banking for instant bank-to-bank transfers. Customers authenticate through their banking app. Payment initiates directly. Confirmation arrives in real-time.

Understanding how Open Banking works for invoicing workflows helps platforms see infrastructure requirements beyond basic payment acceptance.

What Strong Pay by Invoice Infrastructure Provides

When evaluating invoice payment methods, infrastructure capabilities matter:

- Bank-to-bank transfers – Direct account-to-account payments without card networks

- Real-time confirmation – Instant payment status without batch processing delays

- 99% UK bank coverage – Customer bank support including challengers and building societies

- Automated reference handling – Structured payment data for reconciliation matching

- Webhook-based updates – Real-time status notifications without polling

- Usage-based pricing – Transaction fees without percentage-based costs

- FCA-authorised infrastructure – Regulatory compliance through proper Open Banking authorisation

Production-grade pay an invoice workflows should not depend on manual reconciliation or card network fees.

Finexer’s payment infrastructure enables platforms to accept invoice payments through bank transfers with automated matching.

What We See in Practice

After working with UK platforms handling pay by invoice workflows, patterns emerge consistently:

- Card fees are accepted as unavoidable. Platforms assume invoice payments require card processing. Then discover 2–3% fees compound across thousands of transactions monthly.

- Manual reconciliation is treated as temporary. Finance teams match payments manually during early growth. The process doesn’t scale when transaction volume increases.

- Payment references are ignored during implementation. Reference field configuration seems minor. Becomes major when automated matching fails at scale.

- Integration speed prioritised over operational costs. Platforms choose providers integrating in days. Then spend months building reconciliation workarounds.

Common Provider Selection Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Card-only acceptance | High percentage fees | Bank-to-bank transfer support |

| No reference standardisation | Reconciliation failures | Structured payment data |

| Batch status updates only | Delayed visibility | Real-time webhook delivery |

| Limited bank coverage | Customer friction | 99% UK bank support |

| Percentage-based pricing | Costs scale with value | Usage-based transaction fees |

| Manual reconciliation required | Finance team overhead | Automated payment matching |

Platforms often optimise for quick integration without evaluating long-term operational costs. Invoice payment methods that integrate fast but cost 2.5% per transaction become expensive quickly.

Where Finexer Fits

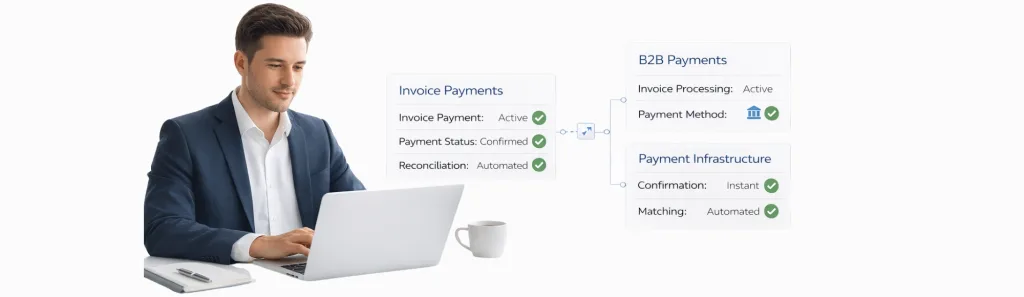

Finexer provides Open Banking connectivity using FCA-authorised infrastructure for UK platforms handling pay by invoice workflows.

We focus on infrastructure enabling reliable payment collection:

- Bank-to-bank transfers across 99% of UK banks including Lloyds, Barclays, Monzo, and challengers

- Real-time payment confirmation via webhooks without polling or batch delays

- Structured payment references for automated reconciliation matching

- Usage-based pricing with transaction fees instead of percentage-based costs

- White-label payment flows maintaining brand throughout customer journey

- 3–5 weeks onboarding assistance ensuring integration aligns with platform architecture

For payroll and invoicing platforms, bank-to-bank infrastructure eliminates card fees on recurring payments.

For accounting and ERP systems, structured payment data enables automated reconciliation without manual intervention.

Finexer does not provide accounting functionality or perform reconciliation logic. We provide payment infrastructure that platforms integrate for pay by invoice features.

How Should Pay by Invoice Be Implemented?

Stable rollout for invoice payment methods typically follows:

- Define payment use cases – Determine transaction types and settlement requirements

- Integrate payment API – Connect bank transfer initiation endpoints

- Configure payment references – Set up structured reference field mapping

- Implement webhooks – Enable real-time payment status notifications

- Test reconciliation logic – Validate automated payment matching

- Deploy with monitoring – Track payment success rates and matching accuracy

This approach reduces reconciliation failures in production environments.

Key Questions Before Choosing an Invoice Payment Provider

When evaluating platforms for pay by invoice infrastructure:

- Does the provider support bank-to-bank transfers or only card payments?

- What percentage of UK banks can customers use for payment?

- Are payment confirmations delivered in real-time via webhooks?

- How are payment references structured for automated reconciliation?

- Is pricing usage-based or percentage of transaction value?

- What reconciliation support is provided during integration?

These questions determine whether invoice payment methods scale without creating operational overhead.

What I Feel About Pay by Invoice Infrastructure

After observing platforms implement pay by invoice infrastructure, the difference between successful and struggling implementations is clear.

Successful platforms treat payment collection as infrastructure they consume. They focus engineering effort on product features, customer experience, and business logic. Not on building payment reference matching or reconciliation systems.

Struggling platforms underestimate reconciliation complexity. They assume payment acceptance solves the problem. Then discover matching failures, reference confusion, and finance team overhead at scale.

Card fees on invoice payments seem acceptable during early growth. They become significant as transaction volume increases. A platform processing £500,000 monthly in invoices pays £10,000–£15,000 in card fees annually.

Infrastructure decisions compound over time. Platforms choosing percentage-based pricing discover costs increase with transaction values. Usage-based pricing provides more predictable economics as invoice amounts grow.

The payment reference detail seems minor during evaluation. It becomes major when finance teams manually match hundreds of payments weekly because automated reconciliation fails.

What is pay by invoice?

Pay by invoice allows customers to receive invoices and complete payment through bank transfer, card payment, or other methods without immediate purchase requirements.

How do invoice payment methods work with Open Banking?

Invoice payment methods using Open Banking enable customers to authorise bank-to-bank transfers directly through their banking app, providing instant payment confirmation without cards.

Can pay an invoice workflows reduce payment processing costs?

Yes, pay an invoice infrastructure using bank-to-bank transfers eliminates card processing fees, reducing costs from 2–3% to usage-based transaction fees.

Do all UK banks support pay by invoice through Open Banking?

Coverage depends on the provider. Leading infrastructure supports 99% of UK banks enabling most customers to pay by invoice via bank transfer.

How long does pay by invoice integration take?

Pay by invoice integration using Open Banking infrastructure typically takes 3–5 weeks including payment flow configuration, webhook setup, and reconciliation testing.

See how Finexer enables instant bank transfers for invoice payments across 99% of UK banks