Access Structured Transaction Intelligence

Stop building parsers. Start using enriched bank transaction data via FCA-authorised infrastructure.

Book Demo NowTable of Contents

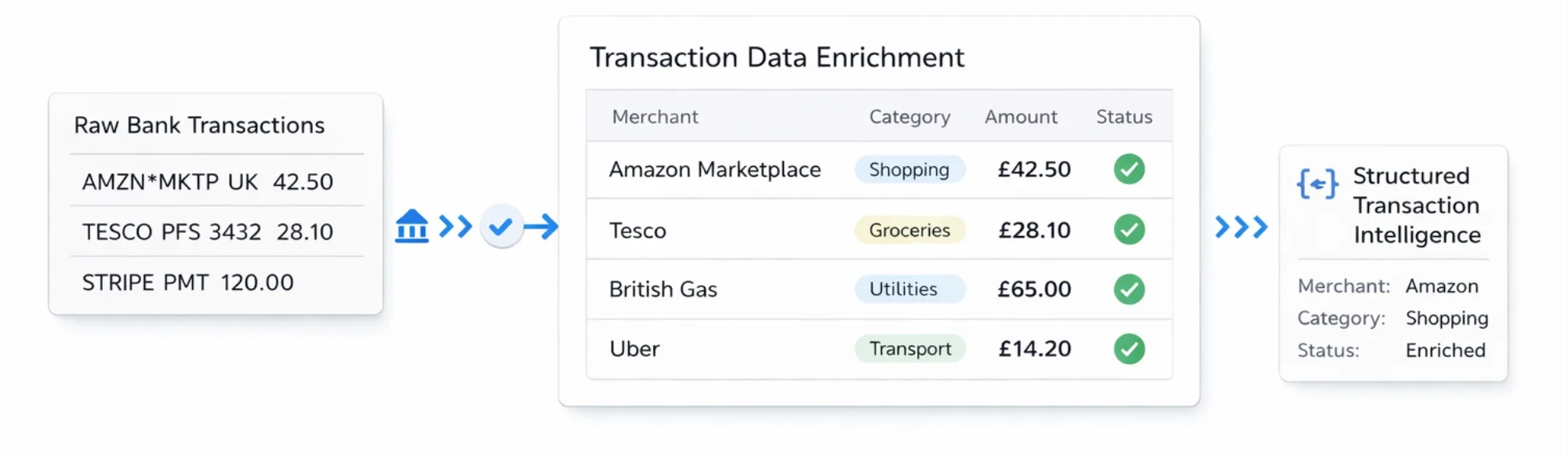

Raw Bank Transactions Are Unstructured Noise

Transaction data enrichment transforms messy bank feeds into structured intelligence that platforms can actually use. Raw transactions arrive as inconsistent merchant strings, missing categories, and unclear counterparties.

Your engineering team shouldn’t maintain regex rules for merchant variations. Enrichment infrastructure delivers normalised names, accurate categories, and metadata through bank-verified sources.

Key Takeaways

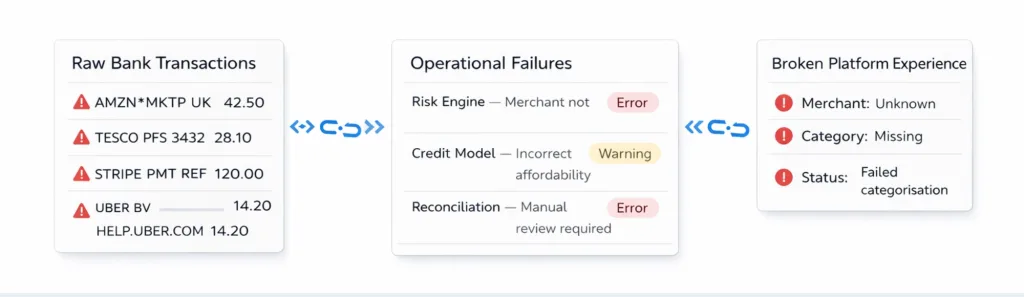

Why do raw bank transactions break platform operations?

Unstructured feeds cause risk engine failures, incorrect affordability calculations, and reconciliation overhead consuming finance team hours.

What does transaction data enrichment actually deliver? Merchant normalisation, automatic categorisation, counterparty identification, and metadata addition at ingestion-not post-storage cleanup.

Why choose APIs over building enrichment internally?

Internal development underestimates merchant variation complexity. Engineering capacity diverted to parser maintenance cannot build product features.

What should platforms prioritise when evaluating providers?

Bank-verified data sources, 99% UK bank coverage, real-time enrichment, historical data support, FCA-authorised infrastructure.

Where does Finexer fit operationally?

FCA-authorised AIS infrastructure providing structured transaction enrichment feeds from 99% of UK banks with real-time categorisation.

Why Raw Bank Transactions Break Platform Operations

Transaction feeds from banks arrive unstructured. Merchant names appear inconsistently. Categories don’t exist. Counterparties remain unclear.

This creates operational failures:

Risk engines misfire on inaccurate merchant identification. Credit models calculate wrong affordability metrics. Accounting reconciliation consumes finance team hours.

User dashboards display confusing descriptions. Payment flows break on unrecognised merchant patterns. Compliance checks fail without proper categorisation.

Teams building fintech platforms, embedded finance products, or SaaS with financial features face identical problems. Raw transaction data enrichment api access without processing cannot power product features.

What Transaction Data Enrichment Delivers

Enrichment transforms raw feeds into usable intelligence through specific operations:

- Merchant normalisation: “AMZN*MKTP UK” becomes “Amazon Marketplace”

- Transaction categorisation: Groceries, transport, utilities assigned automatically

- Counterparty identification: Business vs personal transactions separated

- Metadata addition: MCC codes, transaction direction, payment type included

This happens at ingestion, not post-storage. Platforms receive structured data immediately rather than cleaning retrospectively.

Understanding how transaction enrichment APIs process raw feeds helps technical teams evaluate infrastructure requirements for production implementations.

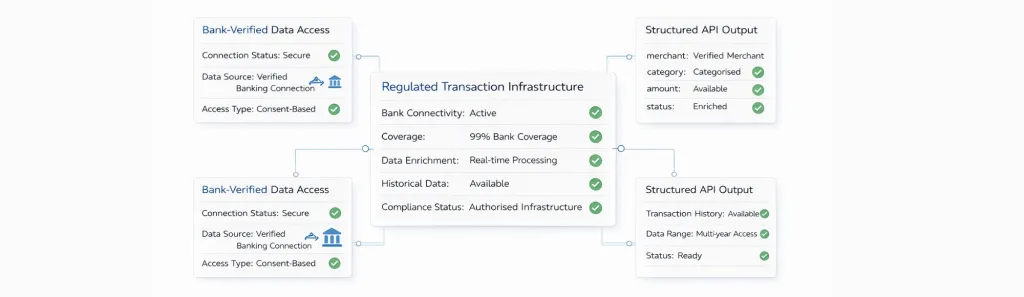

How Transaction Data Enrichment Infrastructure Works

Modern transaction enrichment operates through consent-based architecture:

User authenticates via banking app. Platform accesses transaction feed. The enrichment layer processes raw data. Structured output delivered to product systems.

APIs return enriched transactions in real-time for ongoing feeds and historically for account analysis. Both capabilities matter-platforms need current intelligence and historical context.

What Strong Infrastructure Provides

- Bank-verified data sources: Access through regulated Open Banking connectivity, not screen scraping with compliance risk.

- 99% UK bank coverage: Connectivity to virtually all UK banks ensuring user account compatibility regardless of institution.

- Real-time enrichment: Transactions enriched at ingestion, not batch-processed hours later causing product delays.

- Historical data support: Backfill enriched transactions for account analysis and creditworthiness assessment up to 7 years.

- Structured API outputs: JSON responses with categorised fields, not free-text dumps requiring additional parsing.

- FCA-authorised infrastructure: Compliance through properly authorised AIS connectivity reducing regulatory burden.

Platforms building on unregulated infrastructure inherit compliance risk. Transaction data enrichment APIs operating through FCA-authorised channels provide regulatory protection.

Finexer’s data infrastructure enables platforms to access structured transaction intelligence without building parser maintenance overhead.

Why APIs Beat Internal Development

Internal development costs exceed estimates. Merchant name variations number in thousands. International merchants require separate rules. Data patterns drift as banks change formatting.

Engineering capacity diverted to parser maintenance cannot build product features. Platforms need transaction data enrichment api infrastructure working immediately, not in six months.

The long-tail merchant complexity becomes visible at scale. Initial rules cover 80% of cases. The remaining 20% consume months of engineering effort.

Common Evaluation Mistakes

| Mistake | Why It Matters | What to Look For |

|---|---|---|

| Building parsers internally | Underestimates merchant variation complexity | FCA-authorised enrichment APIs |

| Batch-only processing | Delays real-time features | Real-time enrichment at ingestion |

| Limited bank coverage | User drop-off from unsupported banks | 99% UK bank coverage |

| Screen-scraping infrastructure | Compliance risk, breaks during updates | Regulated Open Banking connectivity |

| No historical enrichment | Cannot analyse account history | Historical data backfill support |

| Self-service integration only | Extended debugging timelines | Hands-on technical support |

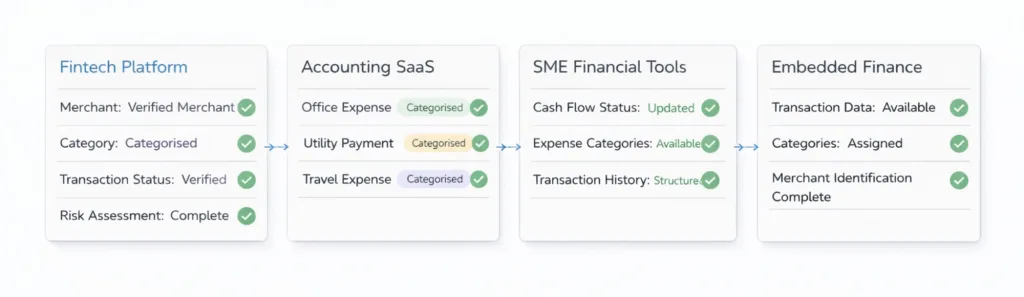

Which Platforms Need Transaction Data Enrichment?

- Fintech platforms: Lending, wealth management products requiring accurate transaction analysis for risk assessment.

- Accounting SaaS: Automated bookkeeping, expense categorisation needing clean feeds for reconciliation.

- SME tools: Cash flow forecasting, spend analytics requiring categorised history for business intelligence.

- Embedded finance: Applications adding financial features without building infrastructure from scratch.

For SME-focused platforms,transaction enrichment APIs for SME workflows provide specific categorisation logic matching business expense patterns.

What I Feel About Transaction Data Enrichment

After observing platforms implement transaction data enrichment, the difference between successful and struggling implementations is clear.

Successful platforms treat enrichment as infrastructure they consume. They invest engineering effort in product features, user experience, and business logic. Not in building merchant name parsers or maintaining categorisation rules.

Struggling platforms underestimate long-tail merchant complexity. They build initial rules covering 80% of cases, then spend months addressing the remaining 20%. The biggest operational burden becomes maintenance, not initial development.

Transaction categorisation accuracy matters critically. Incorrect categories break user dashboards, miscalculate affordability, and undermine trust. Platforms cannot afford trial-and-error approaches when users evaluate financial products.

The infrastructure decision compounds over time. Platforms building parsers internally discover new edge cases monthly. Maintenance overhead increases as the user base grows and the merchant variety expands.

Where Finexer Fits

Finexer provides consent-based access to bank transaction data through FCA-authorised AIS infrastructure:

- Structured transaction feeds from 99% of UK banks including high-street and challenger institutions.

- Real-time enrichment with categorisation and merchant normalisation happening at ingestion.

- Historical transaction access for account analysis enabling creditworthiness assessment and spending pattern evaluation.

- API-first delivery with JSON-structured outputs matching platform integration requirements.

- 3–5 weeks onboarding assistance ensuring integration aligns with platform architecture and business logic.

- Usage-based pricing scales with transaction volume. No percentage fees penalising high-transaction accounts.

Finexer does not make credit decisions or provide compliance advice. We provide enriched data enrichment api access that platforms integrate for financial product features.

What is transaction data enrichment?

Transaction data enrichment converts raw bank transaction feeds into structured, categorised data with normalised merchant names and metadata enabling product features.

How does a transaction data enrichment API work?

Platforms access bank transactions via consent-based Open Banking connectivity, receive enriched data through APIs with categorisation and merchant information added at ingestion.

Does transaction enrichment work with all UK banks?

Yes, with 99% UK bank coverage through Open Banking infrastructure, virtually all user accounts work regardless of whether they bank with high-street or challenger institutions.

What happens to transaction data security?

All access operates through FCA-authorised infrastructure with user consent, ensuring transaction data enrichment handling meets UK regulatory requirements for data protection.

How long does integration take for transaction data enrichment APIs?

Typically 3–5 weeks with dedicated onboarding assistance from the engineering team, though timelines vary based on platform architecture complexity and existing systems.

See how Finexer powers transaction data enrichment for platforms building financial features